2015 National Consumer Protection Week – March 1-7, 2015

March 6th, 2015

National Consumer Protection Week is a campaign to encourage consumers nationwide to take full advantage of their consumer rights and make better-informed decisions. An important consumer protection topic centers on protecting oneself when in need of fast, small-dollar cash loans. Unfortunately, a large number of Mississippi consumers still use high-cost or predatory financial services. Mississippi must create policies that promote financial inclusion so that Mississippians have the tools available to securely save and build wealth, as well as the opportunity to pass good savings behavior onto their children.

Underbanked households describe the percentage of households that have a traditional, mainstream banking account but still use alternative and costly financial services outside of the banking system, like payday loans. These services deplete rather than preserve income and wealth. According to a Pew report on payday lending in America, the average payday loan borrower takes out eight payday loans of $375 each per year and spends upwards of $520 on interest. Households that use alternative financial services, like payday loans, are more likely to face difficulty building credit and achieving overall financial security.

Mississippi has the highest rate of underbanked households in the nation – 32.8 percent of Mississippi households are underbanked, compared to only 20 percent of U.S. households.

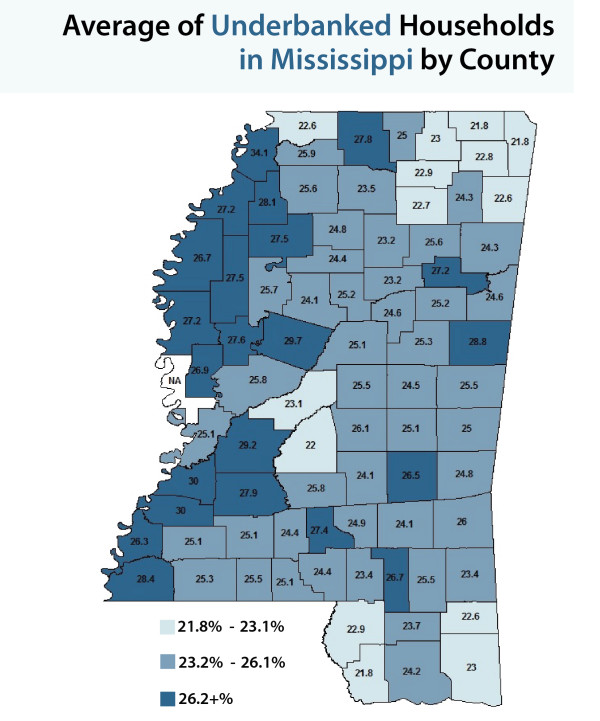

Likewise, all counties in Mississippi have underbanked rates higher than the national average (See Map). Three counties have underbanked rates in excess of 30 percent (Claiborne, Jefferson, and Tunica Counties). Alcorn, Hancock and Tishomingo Counties have the lowest underbanked rates, accounting for nearly 22 percent of households in each county.

The data underscore the importance of implementing policies that promote financial inclusion. Examples include expanding support for Community Development Financial Institutions and Community Development Credit Unions that continually work to meet the needs of historically underserved populations.

Sources:

Corporation for Enterprise Development. (2014). Assets & Opportunity Local Data Center, 2014.

Corporation for Enterprise Development. (2015). Assets and Opportunity Scorecard, 2015.