Findings from the Survey of Household Economics and Decision Making – Part 2

June 29th, 2022

By Kiyadh Burt, Vice President of Policy & Advocacy and Interim Director

This blog represents the second of two blogs that unpack findings from the Federal Reserve Board annual Survey of Household Economics and Decision Making. In the previous blog (hyperlink), we paid particular attention to gaps in banking and credit access and housing. Notably, we found higher rates of households that were fully banked among white and Asian households relative to rates for Black and Hispanic households. Similar patterns emerged around homeownership as well. In this blog, we focus on effects of the overall economy on economic well-being, income and expenses.

Economic Well Being

Low-income parents, in particular, reported significant gains in overall economic well-being. From 2020 to 2021, households with children earning less than $25,000 reporting “doing okay financially” rose from 40% to 53%. Likewise, families earning between $25,000 and $50,000 reported gains as well. Interestingly, the expanded Child Tax Credit was identified as a key driver of the growth associated with this indicator – an important signal of the impact of guaranteed income. At the same time, the policy failed to meaningfully close gaps by class, race, and geographic markers. Low- and moderate-income adult gains did not reach levels of high-income earners. Among adults earning over $100,000 a year, 96% reported “doing okay financially” in contrast to 55% of adults with less than $25,000 in income. Black households also reported lower levels of well-being relative to that of all other racial and ethnic groups. Among rural households only 1/3 reported “doing okay” – 19 percentage points below levels reported prior to the pandemic and well behind levels in metro areas.

Income

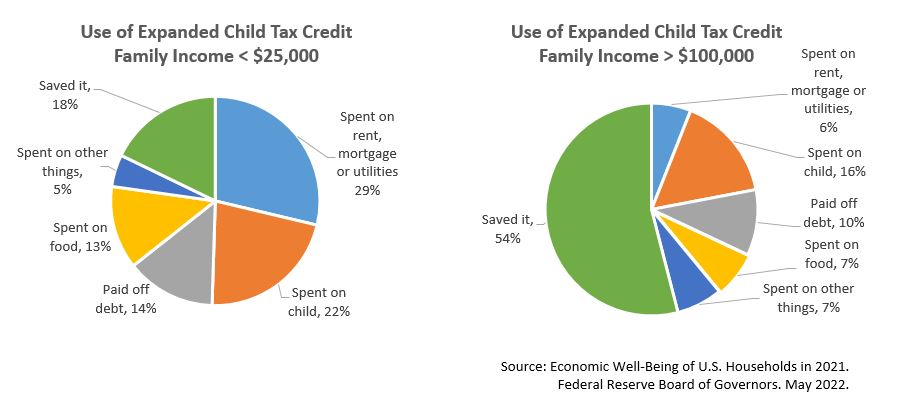

Additional evidence on the impact of the Child Tax Credit emerged around the way it was used – particularly for families earning less than $50,000 a year. Over 50% of tax credit expenditures were either spent on rent, a mortgage or utility payments, or directly on a child. In contrast, in households earning $100,000 or more, over half (54%) put the expanded Child Tax Credit payments into savings.

Another finding focused on the prevalence of spikes and dips in income. Black and Hispanic households were more likely than other racial and ethnic groups to experience income variability. The same was true for households with someone with a disability.

Expenses

Black and Hispanic adults were much more likely than white or Asian adults to face difficulty paying bills, and this condition persisted across all income levels. Fifty-three percent (53%) of Black households and 48% of Hispanic households earning less than $50,000 a year would not be able to fully pay bills after an unexpected $400 expense. These levels stood in contrast to 38% for white households. Also, one out of four adults skipped a visit to the doctor or some type of health-related treatment due to cost.

Looking ahead

In the face of long-standing disparities across a range of financial and economic indicators, policy solutions that bridge racial gaps in income and wealth remain more necessary than ever. On matters of income, the take-up and use of the expanded Child Tax Credit makes a strong case for a guaranteed basic income solution – particularly for low- and moderate-income families. As income is stabilized, sustained investments into Community Development Financial Institutions and Minority Depository Institutions (MDI) with long track records of success serving people and communities of color offer a proven path for expanding financial service access and ultimately closing the racial wealth gap.