Mississippi State and Local Government Revenue FY 2009

December 12th, 2011

This past October, the US Census Bureau released state specific data on state and local government finances. The report included data on revenue collections from sources such as income taxes, property taxes, and general sales and was used to calculate the two measures most commonly used to compare state and local tax revenue levels—revenue as a percent of personal income and revenue per capita.

Why Do These Revenue Calculations Matter?

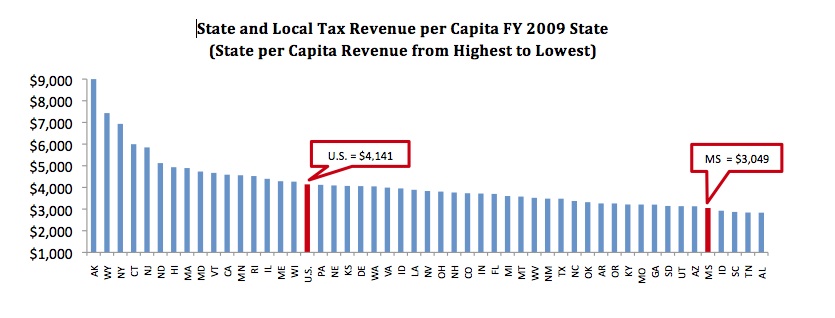

Interestingly, Mississippi was in the middle of the pack among state and local tax revenue as a percentage of total personal income, but was near the end of the ranks when considering state and local tax revenue per capita. Revenue as a percent of personal income and revenue per capita are just two ways of viewing state revenue. However, the difference between the two measures highlights the regressive nature of Mississippi’s overall tax system.

You can read more about our state’s rankings in MEPC’s fact sheet Mississippi’s State and Local Government Revenue FY 2009.