Recently, the FINRA Investor Education Foundation released the 2012 National Financial Capability Study (NFCS), which examines the financial landscape in the United States, including how well consumers manage their finances. For the purpose of this study, the concept of financial capability expands the notion to more than an individual’s demonstrated knowledge of specific terms and concepts; it also examines underlying demographic, behavioral, attitudinal and financial literacy characteristics that affect how individuals manage their money and make financial decisions. The 2012 NFCS, which focuses on key measures of financial capability, reveals that many Americans continue to struggle to make ends meet, plan ahead, and make financial decisions. The following section outlines how Mississippi stacks up against the same criteria.

- Making Ends Meet. In the past year, a significant number of Mississippians spent more than their household income or spent about the same to break even. Twenty-two percent (22%) of individuals in the state reported that they spent more than their household income (excluding the purchase of a new home, car or other major investment), while 38 percent spent about the same as their household income.

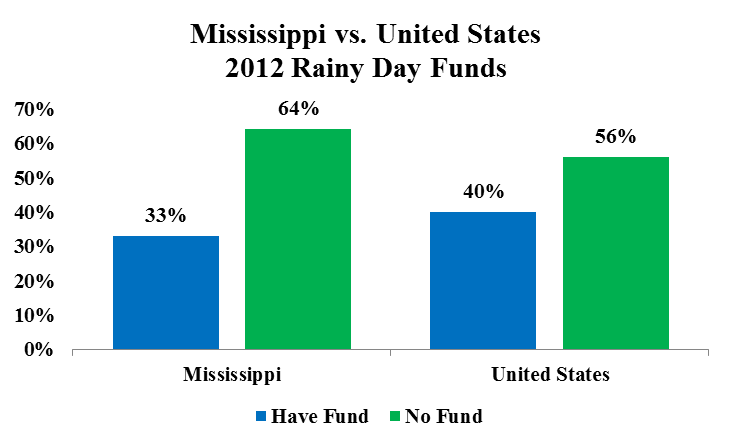

- Planning Ahead. Most Mississippians did not have a “rainy day” fund, meaning that they did not have the financial resources to weather any type of financial crises for three months in the absence of income. Sixty-four percent (64%) of Mississippians did not have a “rainy day” fund and lacked adequate protection against financial emergencies like a job loss or medical emergency. See Chart.

- Managing Financial Products. Thirty-eight percent (38%) of Mississippians engaged in non-bank borrowing within the past five years, using check cashers, payday loan providers, pawn shops, auto title lenders and rent-to-own stores. Non-bank borrowing can hinder an individual’s finances as these types of services often come with high interest rates that deplete rather than preserve income and wealth.

- Financial Knowledge. NFCS respondents were asked five basic questions related to economics and finance encountered in everyday life. Mississippians demonstrated low levels of financial literacy – 68 percent were unable to answer more than three of the five questions correctly.

The data underscore the importance of implementing policies that promote access to the financial mainstream, so more consumers have adequate informational resources, affordable financial services and appropriate consumer protections. When individuals are attached to the financial mainstream, they have the tools available to participate in asset building and have greater financial stability, as well as the opportunity to pass good financial habits onto children. Examples of such policies include expanding support for Community Development Financial Institutions (CDFIs) and Community Development Credit Unions (CDCUs) to continue the work of meeting the needs of historically underserved populations.

Source:

FINRA Investor Education Foundation. (2013 May). Financial Capability in the United States: Report of Findings from the 2012 National Financial Capability Study. Retrieved from http://www.usfinancialcapability.org/