Update from the Mississippi State Capitol: Tax Cuts Clear Another Legislative Hurdle

April 8th, 2016

A legislative tax cut proposal that would eliminate taxes on income up to $5,000 passed the House of Representatives and will move on to conference negotiations with the Senate. While the House plan is scaled back considerably from the original Senate plan, it would still do very little to help low-income working families.

Earlier this week, the House of Representatives considered the Senate tax cut plan that would cut about $575 million in income and corporate taxes. The House Ways and Means Committee took up the bill and amended it to cut out some of the income tax cuts and the franchise tax elimination. The amended plan would eliminate the income tax on individual taxable income up to $5,000, which is currently taxed at 3%. The plan would go into effect in the 2017 tax year and cost an estimated $145 million. While the cut’s full effect on the state budget would not be realized until FY 2018, it would reduce revenue in FY 2017 as well due to reductions in withholding.

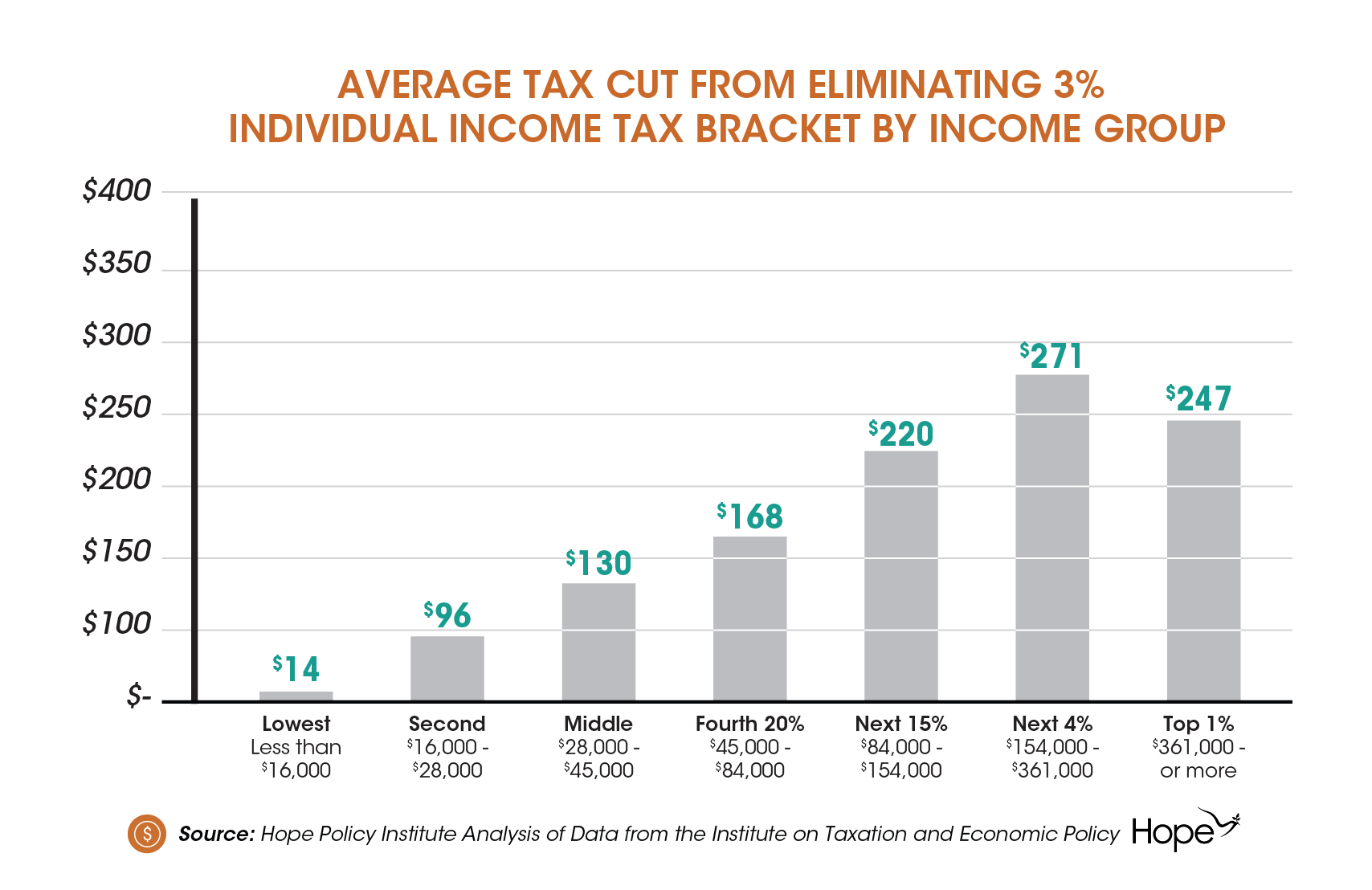

The chart below shows what the proposal would do for families of different income groups. The average family in the lowest income group would get a $14 cut from the bill while average tax cut for families in the top 1% would be $247.

The House plan would do little for Mississippi families who already pay little to no state income taxes. While the lowest-income Mississippi households owe no state income tax they do pay a large amount of other taxes. In fact, the lowest-income households pay in sales tax, on average, a share of their income seven times greater than the top one percent of households.

Over the next couple of weeks, the tax cut proposal will undergo negotiations between House and Senate conferees. If the conferees come back with a shared proposal, it will then have to be voted on again by both the House and Senate.

Recently, Hope Policy Institute released a brief that examined why large tax cuts don’t help working families who are struggling to make ends meet. The cuts would hurt the state’s ability to invest in resources like education and workforce development that would move the state forward. Follow us on Facebook, Twitter and sign up for our newsletter to stay up to date on latest tax and budget issues in Mississippi.