Eliminating the State Income Tax in Mississippi: Tax Cut or Tax Shift?

February 24th, 2015

Eliminating the individual income tax would mean either a massive erosion of resources for education and other priorities or a tax shift from wealthy Mississippians to working families who are struggling to make ends meet.

Eliminating the individual income tax would mean either a massive erosion of resources for education and other priorities or a tax shift from wealthy Mississippians to working families who are struggling to make ends meet.

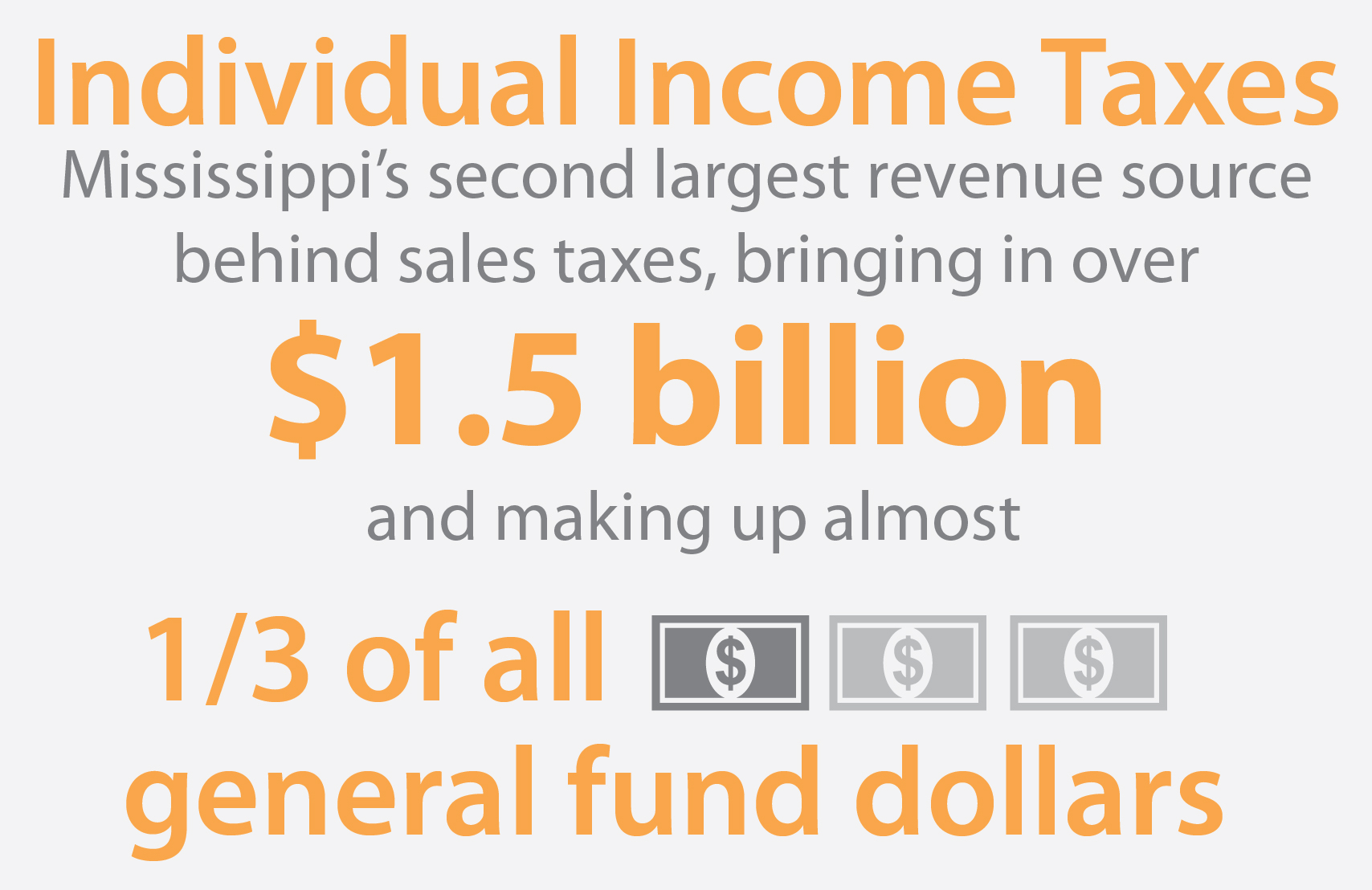

Individual income taxes are Mississippi’s second largest revenue source behind sales taxes, bringing in over $1.5 billion annually and making up almost one third of all general fund dollars that support schools, universities, mental health resources, public safety, and other key services.

If we eliminate the income tax, in order to avoid drastic cuts to vital state services like schools and universities, revenue would have to be raised in other ways like sales taxes and property taxes—taxes that hit lower and middle income Mississippians especially hard. Instead of a tax cut, it would result in a tax shift from the wealthy Mississippians to low and middle income working families who are struggling to make ends meet. Lower and middle income working families already shoulder more of the tax burden than wealthy Mississippians.

Most other states that do not have an income tax have special circumstances that allow them to collect revenue in other ways, like royalties from natural resources (as in Alaska, South Dakota, Texas and Wyoming) OR revenue from major tourism industries (as in Florida and Nevada).

Recent major income tax cuts in states like Kansas and North Carolina have resulted in budget disasters for those states without the quick economic gains that were promised when the cuts were made.

A drastic income tax cut will not boost our economy. States promote real, long-term economic growth by investing in quality schools to educate a skilled workforce; a modern infrastructure that enables companies to bring their products to market and safe, stable communities. All of these things require long term public investment that would be jeopardized if we eliminate our income tax.