Part 2: Making Mississippi’s Income Tax More Equitable—The Earned Income Tax Credit

January 13th, 2012

Our first post addressed the increasing gap between the state tax threshold and the federal poverty line. One policy solution that would reduce the effect of the state income tax on the poor is for our state to institute an Earned Income Tax Credit (EITC).

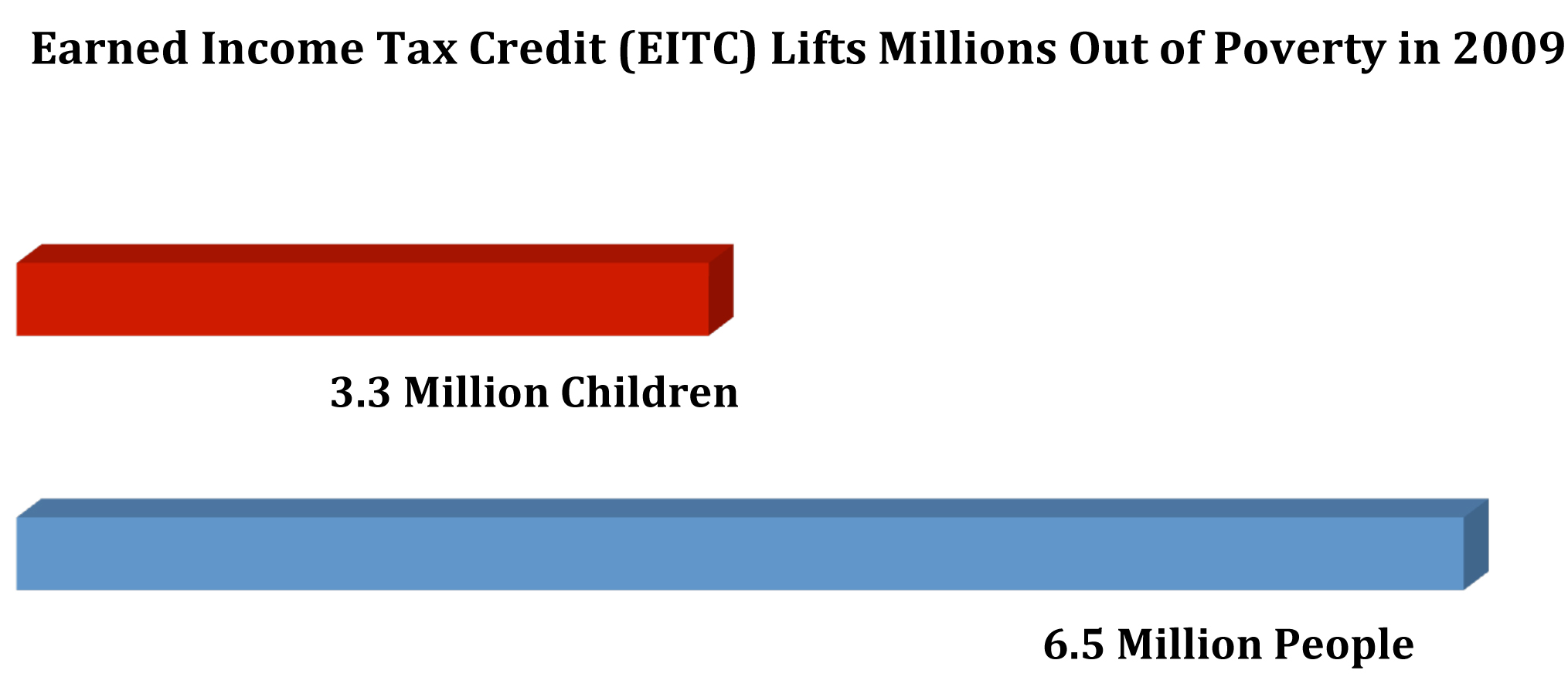

The federal EITC is the nation’s most effective anti-poverty program for working families.¹ It is designed to encourage and reward work as well as offset federal payroll and income taxes. In 2009, it lifted 6.5 million people above the federal poverty line—including 3.3 million children, nationally. Additionally, the federal EITC is refundable, meaning that if it exceeds a low wage worker’s income tax liability, the IRS will refund the balance.

404,394 Mississippians claimed the federal EITC in 2011 which brought an additional $1.5 billion into our state.² A state EITC would reduce the income taxes owed and provide a wage supplement for over 360,000 working families living in or near poverty in Mississippi. Finally, a state EITC that is tied to the federal EITC is automatically adjusted.

The next blog in this series will talk about the estimated cost and eligibility requirements for a state EITC while also describing the work benefits that an EITC could create in our state.