Reforming the Community Reinvestment Act Regulatory Framework

November 27th, 2018

November 19, 2018

The Honorable Joseph Otting

Comptroller of the Currency

Office of the Comptroller of the Currency

400 7th St. SW #3E-218

Washington, DC 20219

Comment: Reforming the Community Reinvestment Act Regulatory Framework

Docked ID: OCC-2018-0008

Dear Comptroller Otting:

Please find attached the comments of the Hope Enterprise Corporation / Hope Credit Union (HOPE) in response to the Advanced Notice of Proposed Rulemaking (ANPR) on Reforming the Community Reinvestment Act Framework Docket ID OCC-2018-0008.

HOPE is a credit union, community development financial institution and policy institute that provides affordable financial services; leverages private, public and philanthropic resources; and engages in policy analysis to fulfill its mission of strengthening communities, building assets, and improving lives in economically distressed areas throughout Alabama, Arkansas, Louisiana, Mississippi and Tennessee. Over the last 25 years, HOPE has generated over $2 billion in financing that has benefited more than one million individuals. On behalf of the people and places we serve across the Deep South, we respectfully submit the following comments in response to proposed reforms to the Community Reinvestment Act.

The Importance of the Community Reinvestment Act (CRA) in the Deep South

Deep South Financial Services Gap

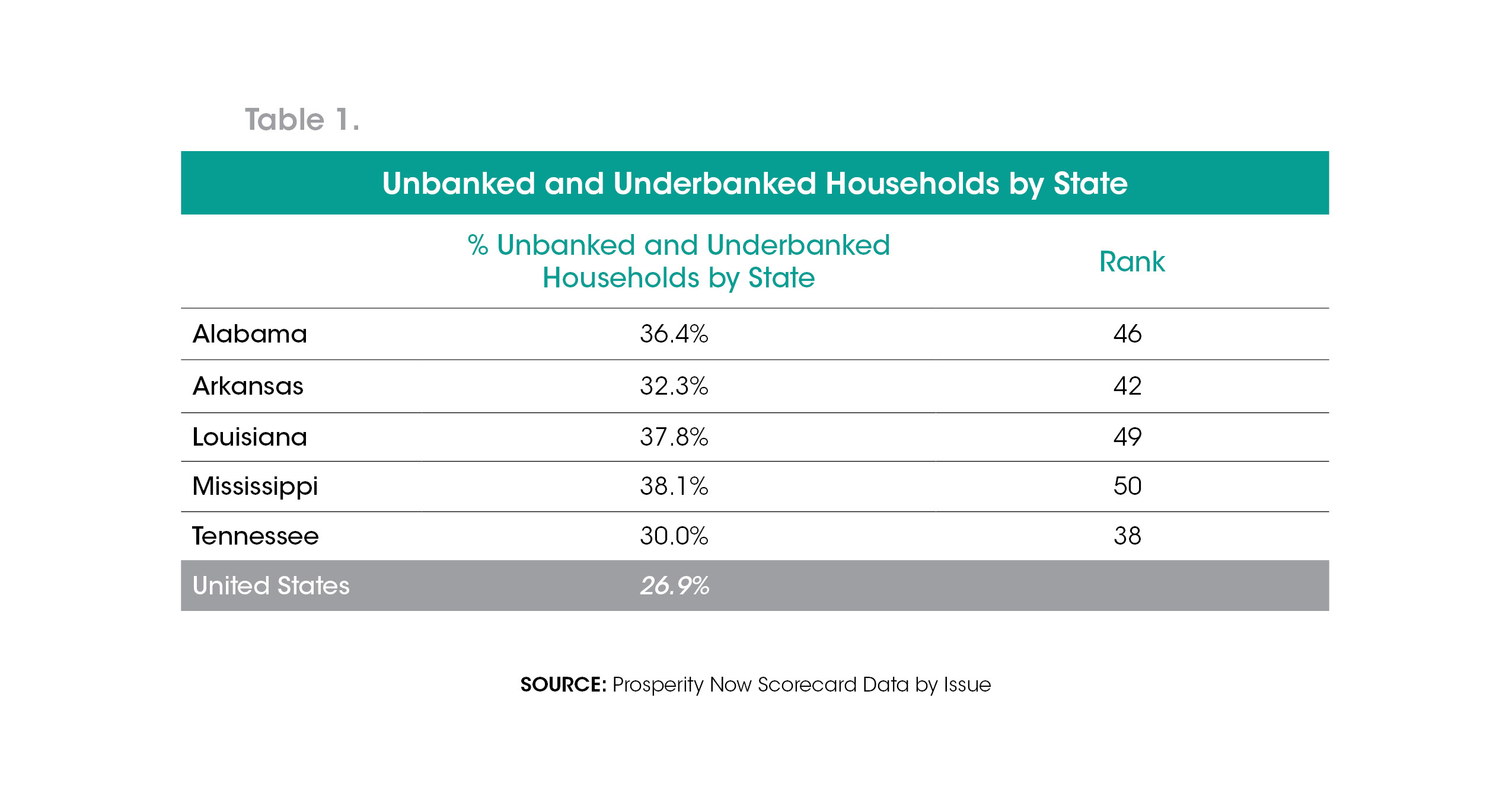

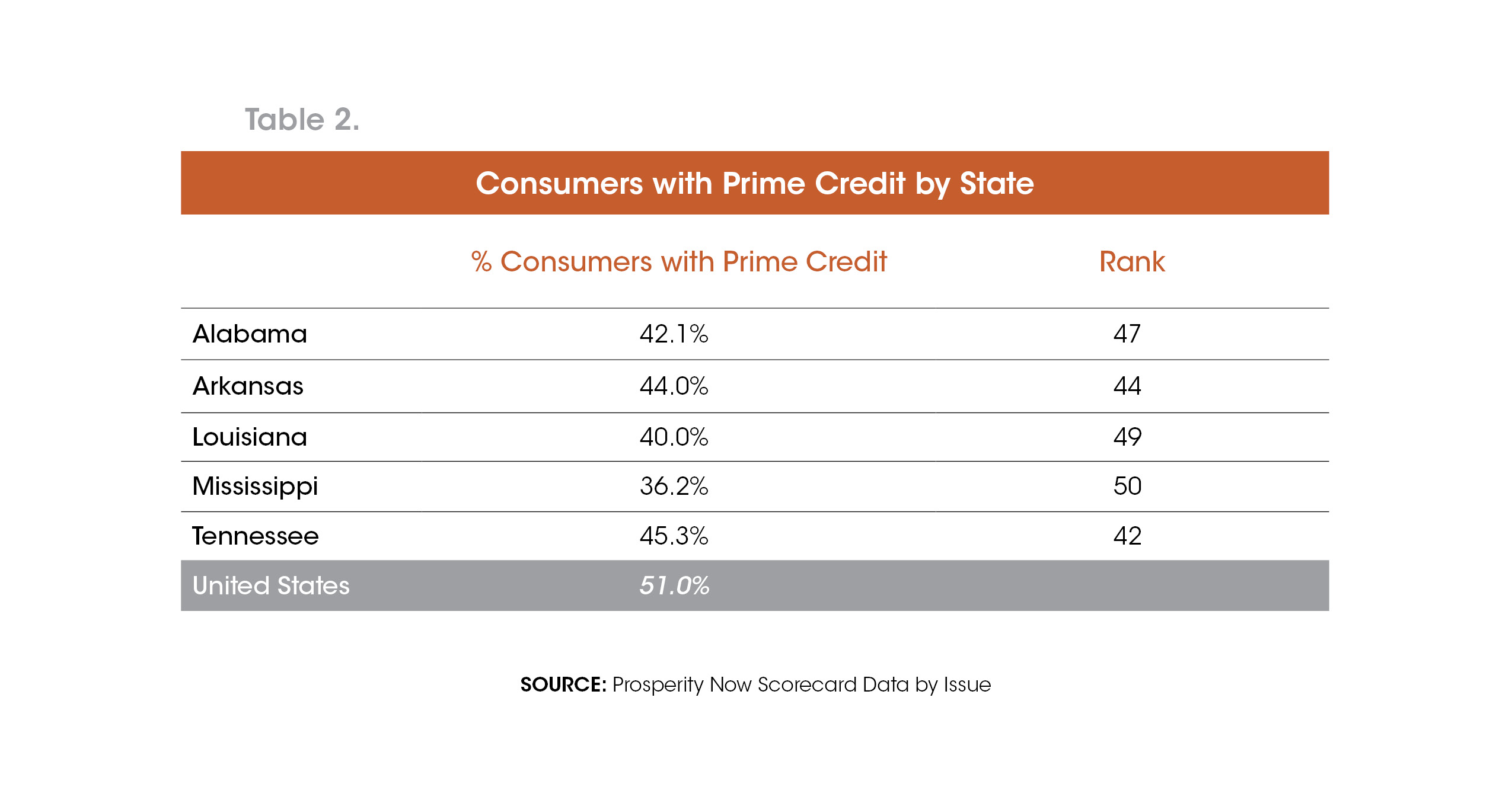

Nearly 1/3 (32%) of the United States’ persistent poverty counties – counties where the poverty rate has eclipsed 20% for three decades in a rowi – are in the Deep South States of AL, AR, LA, MS and TN. Moreover, four of these states are among the 10 with the highest poverty rates in America. The effects of poverty spill over into the financial marketplace for consumers. Tables 1 and 2 show the high rates of unbanked and underbanked households in the Deep South as well as the absence of prime credit.

The high rates of unbanked and underbanked households combined with low levels of credit begin to illustrate the size of the financial service gap in the Deep South states and underscore the importance of CRA in remediating both the provision of services and lending.

Gaps in business values by race – particularly in Mississippi and Alabama – suggest that disparate access to capital limits start-up and growth opportunities for African American entrepreneurs. In Mississippi, for example, average business receipts by white owned businesses are, on average, 8 times larger than average business receipts by black owned businesses.ii As a point of comparison, this same gap is 3:1 nationwide.

CRA and its role in closing the Financial Service Gap in the South

By almost any measure of investment, CRA dwarfs other efforts to spur community development investments that address the Deep South Financial Service Gap. Analysis conducted by the Federal Reserve Bank of Atlanta estimates approximately $7.7 billion annually in community development lending and investment is made available through CRA motivated bank activities in the Southeast.iii As a point of comparison, total CDFI Fund New Markets Tax Credit Qualified Low-Income Community Investments located in the Deep South since the 2003 inception of the program do not add up to the annual amount of CRA motived investments in this part of the country.iv Further analysis by the Federal Reserve System found that philanthropic investment in the South is significantly smaller than CRA facilitated investments. Philanthropy made $15 billion in investments nationwide over the six year period of 2008 to 2013 for community and economic development purposes.v In the Mississippi Delta / Black Belt, two of the most economically distressed regions nation, the National Committee for Responsive Philanthropy reports only $55 million in total philanthropic grant making from 2010-2014.vi

We are deeply concerned that proposed CRA reform measures would result in a significant loss of retail financial services, small business lending and home lending in low- and moderate-income areas, among low- and moderate income people and people of color. Estimates conducted by the National Community Reinvestment Coalition cite a range of $2.3 million to $4.6 billion in losses over a five-year period for the Deep South states of AL, AR, LA, MS, and TN. Given the economic distress levels of the Deep South – a loss of several billion dollars in reinvestment would exacerbate the effects of poverty and lack of access to financial services.

Metric Based Framework (Questions 1-12)

HOPE Recommendation: HOPE opposes any move to a metric based framework for CRA purposes

We have deep concerns that any move to a metric based framework from the existing framework would result in two harmful outcomes for low-income people and communities. First, a metric based framework could incentivize banks to make large investments in communities of limited impact. Consequentially, CRA regulatory obligations could be met with fewer investments, and smaller, more difficult transactions in more distressed parts of an assessment area could be overlooked. Indeed, referencing the small business value gap between white owned businesses and black owned businesses in the Deep South states, such an approach would widen gaps in business ownership and further limit access to capital for entrepreneurs of color.

Second, as large investments / loans crowd out more difficult and smaller investments, one investment casualty could be CRA-motivated loans and investments in Community Development Financial Institutions (CDFIs). CDFIs, in particular, specialize in the provision of financial services for low-income people and communities. By law, 60% of all CDFI lending must occur in census tracts with poverty rates in excess of 20%, median family incomes below 80% of the Area Median Family Income, unemployment rates in excess of 1.5 times the national average, significant population loss or be located within an Empowerment Zone or Enterprise Community.vii

Banks recognize, with the encouragement / requirement of CRA, that CDFIs are well positioned to serve low-income communities. HOPE currently has $5.6 million in outstanding community development loans from banks that support the provision of payday loan alternatives to low-income residents of the region, mortgage and small business lending in low-income census tracts in Memphis, TN and investments to support partnerships with Historically Black Colleges and Universities and small town redevelopment in rural areas. One quarter (25%) of HOPE’s retail branches were CRA motivated donations from a large regional bank. The median poverty rate of the census tracts where the branches are located is 41.6%. In the absence of CRA – those branches would no longer exist.

Additionally, CDFIs have the added advantage of being rooted in low-income communities and use knowledge shared by local people to expand access to lending and financial services. For example, of Hope Credit Union’s 29 locations, 24 (83%) are located in majority black counties and 23 (79%) are located in economically distressed census tracts. In five communities, HOPE is the only federally-insured depository institution. Annually, HOPE hosts member meetings throughout its footprint and convenes quarterly local advisory committees to gather feedback on the types of products and services required by local people to meet their financial needs.

Any effort resulting in diminished investment in CDFIs will have the direct effect of reducing community influence in determining the types of lending, investments and services that occurs in low-income communities and communities of color. The replacement of the existing structure, while not perfect, with a metric based approach will further distance community reinvestment from the necessary local context that is essential to effective community development, fair lending and poverty alleviation.

Redefining Communities and Assessment Areas (Questions 13-14)

HOPE Recommendation: Assessment Areas should be expanded in a manner that increases investment in rural persistent poverty communities and economically distressed places where the nation’s largest banks have no obligation to reinvest

Far too many rural, persistent poverty counties remain outside the reach of bank Assessment Areas. As a result, places with great CRA needs and strategies to support lending and investment in them are simply not considered. The Mississippi Delta serves as a vivid case study of this phenomenon. Analysis conducted by the Federal Reserve of Atlanta on the Assessment Areas of the 20 largest depositories in the Southeast shows that only one bank reports Assessment Area in the Mississippi Delta and only two banks report Assessment Area in the Louisiana Delta.viii Additionally, analysis conducted by HAC further affirms the limited reach of CRA in rural areas as most banks with rural Assessment Areas experience exams that are limited in scope.ix

One way to remedy this current Assessment Area limitation would be to require / incentivize CRA investments in rural economically distressed communities where national and regional banks have some loans and deposits or otherwise generate revenue. Banks with national footprints – both those with physical branches and those without physical branches – should receive credit for investing in rural, persistent poverty areas, or in CDFIs that have a presence in these communities.

Expanding CRA-Qualifying Activities (Questions 15-28)

Question specific responses are outlined below.

Question 15: How should community and economic development be defined to better address community needs and to incentivize banks to lend, invest and provide services that further the purposes of the CRA?

Low-income designated, community development credit unions like HOPE expand access to financial services by leveraging secondary capital loans – long term, low-cost loans subordinate to all other outstanding liabilities. Secondary capital loans made by banks for CRA purposes to low-income designated credit unions, however, only generate credit for banks in the year of origination. As a result, banks engage in shorter term lending to CDFIs, or avoid the strategy altogether. This disincentive to lend to low-income designated credit unions could be remedied by granting CRA credit to banks for secondary capital loans to low-income designated credit unions for each year the loan is outstanding. Greater incentives for banks to lend to low-income designated credit unions would result in expanded lending and services by low-income designated credit unions that best understand the unique financial needs of low-income communities.

Question 23: Under what circumstances should small business loans receive CRA consideration? For examples, should consideration be given to all loans to businesses that meet the Small Business Administration standards for small businesses?

HOPE disagrees strongly with any regulatory change in the definition of a small business that would increase the size of small businesses contemplated by the current regulation for CRA credit when small business loans are originated by banks. The current definition of a small business with less than $1 million in revenue is more than sufficient and necessary to ensure that the entrepreneurs most in need of capital are not overlooked – particularly entrepreneurs of color and women. Over the two-year period of 2016-2017, HOPE originated commercial loans to 76 businesses. Three out of four (78%) of the businesses that received a loan from HOPE had revenues of less than $1 million.

Question 27: Should bank delivery channels, branching patterns, and branches in LMI areas be reviewed as part of the CRA evaluations? If so, what factors should be considered?

Any changes to the CRA should still place significant weight on a service test that evaluates the presence or absence of branches in low-income communities or strategies to maintain access to depository services in the event of an exit by a bank.

In HOPE’s experience, the presence of the service test has been instrumental to enhancing access to financial services via branches in the Mississippi Delta. In 2015 and 2016, a large regional bank began exploring options to optimize its branch presence in Mississippi. The bank reached out to HOPE to explore an innovative partnership to keep financial services in very small, high poverty towns. Ultimately, the bank chose to transfer the physical branches to HOPE, provide opportunities to market HOPE’s services to existing bank customers prior to the transfer and invested in HOPE’s start-up costs. Table 3 illustrates some of the characteristics associated with the towns.

Prior to the transfer, the bank did not provide an adequate range of financial services in these Delta Branches. When the new branches opened under HOPE’s management, financial offerings were expanded to include the opening of deposit accounts, and the origination of consumer, mortgage and small business loans. In the absence of a robust service test the innovative partnership between HOPE and the bank would most likely not have happened, and three communities would have been relegated to bank deserts.

Beyond HOPE’s experience, several studies note the transformative effect of bank branches on other aspects of community development. NCRC has documented decreases in poverty associated with the presence of bank branches and increased rates of small business lending in Appalachia. Likewise, the Federal Reserve finds that the cost of mortgage credit decreases when a bank branch is present in a community.x

Recordkeeping and Reporting (Questions 29-31)

The race of small business owners applying for credit and being granted credit should be required to be collected and reported publicly

Research conducted by the Association for Enterprise Opportunity (AEO) documented high demand for credit among black owned businesses, a lack of bank financing to meet the demand; and lower approval amounts and rates for black business owners than white business owners.xi In order to begin addressing the small business credit gaps between black and white business owners, a credible, comprehensive, public source of data should be made available to measure the size of the lending gap and to measure any progress or regression in closing it on a routine, predictable basis. CRA small business lending reporting requirements are obvious place to make policy improvements in this regard and the race of all small business loan applicants and originations should be reported.

The Home Mortgage Disclosure Act (HMDA) offers a template for the administration of such a rule where lenders are required to collect data on the race of applicants and the race of owners for whom a mortgage origination is made. Additionally, a series of reports regarding originations by race are made available for public review. The collection of such data allows for analysis geared towards the identification of patterns of lending discrimination. The public reporting serves as an important deterrent for conscious or unconscious bias in the making of lending decisions affecting borrowers of color.

Thank you for the opportunity to share our perspective on the proposed rule changes concerning the Community Reinvestment Act. As next steps are considered, we encourage the OCC to honor the spirit of interagency cooperation and for all of the regulators charged with the implementation of this important policy to act on one accord to preserve fair and responsible financial services for all.

Sincerely,

William J. Bynum

Chief Executive Officer

i Analysis conducted by the Hope Policy Institute of the US Treasury CDFI Fund published List of Persistent Poverty Counties updated in October 2017. https://www.cdfifund.gov/Documents/PPC%20updated%20Oct.2017.xlsx. Accessed 11/10/2018.

ii Prosperity Now Scorecard. “Business Values by Race.”

http://scorecard.prosperitynow.org/data-bylocation#state/ms. Accessed on 11/17/2018.

iii Lambe, Will and Jessica Farr. Community Reinvestment Act: How Much Is it Worth in the Southeast? https://www.frbatlanta.org/community-development/publications/partners-update/2015/05/151016-communityreinvestment-act-how-much-is-it-worth-in-the-southeast.aspx.

September / October 2015. Accessed on 11/6/2018.

iv Analysis conducted by the Hope Policy Institute of the US Treasury CDFI Fund FY2017 NMTC Public Data Release. https://www.cdfifund.gov/Documents/Forms/DataReleases.aspx.

Accessed on 11/10/2018.

v Keith Wardrip, William Lambe, and Mels de Zeeuw, “Following the Money: An Analysis of Foundation Grantmaking for Community and Economic Development,” Foundation Review, 8 (Special Issue: Future of Community) (2016).

vi Schlegel, Ryan and Stephanie Peng. As the South Grows on Fertile Soil. https://www.ncrp.org/wpcontent/uploads/2017/04/As-the-South-Grows-On-Fertile-Soil.pdf.

National Committee on Responsive Philanthropy. 2017. Accessed on 11/10/2018.

vii Frequently Asked Questions (FAQ) CDFI Investment Area Transition to the American Community Survey 20112015 Data (October 1, 2018) https://www.cdfifund.gov/Documents/CDFI%20Investment%20Areas%20potential%20FAQs%20FINAL%20100118. pdf.

Accessed 11/12/2018.

viii Lambe, Will and Mindy Kao. Community Reinvestment Act: Geographies and Strategies in the Southeast. https://www.frbatlanta.org/community-development/publications/partners-update/2015/04/150824-crageographies-and-strategies-in-southeast.aspx.

July / August 2015. Accessed 11/18/2018.

ix Reforming the Community Reinvestment Act Regulatory Framework. http://www.ruralhome.org/storage/documents/policy_comments/HAC_CRA_Comments_FINAL_11.16.pdf

HAC. November 16, 2018. Accessed 11/18,2018.

x Bynum, William J. Diana Elliott and Edward Sivak. Opening Mobility Pathways by Closing the Financial Services Gap. file:///C:/Users/esivak/AppData/Local/Packages/Microsoft.MicrosoftEdge_8wekyb3d8bbwe/TempState/Downloa ds/financial_services_paper%20(1).pdf.

February 2018. Accessed 11/12/2018.

xi The Tapestry of Black Business Ownership in America. https://aeoworks.org/images/uploads/fact_sheets/AEO_Black_Owned_Business_Report_02_16_17_FOR_WEB.pdf

Association for Enterprise Opportunity. 2/2017. Accessed on 11/18/2018.