Southern States Must Act With Urgency to Protect Stimulus Checks from Debt Collectors

May 4th, 2020

Over 80 million federal CARES Act stimulus payments have been distributed in the past two weeks. Just under half are still left to be sent nationally, with some of the most financially vulnerable people set to begin receiving their payments this week.[1] With the majority of the stimulus payments expected to go towards paying bills and other essential needs, [2] state officials must quickly enact protections to prohibit debt collectors from garnishing checks before people can put the money toward rent, or utilities, prescriptions or food.

While COVID-19 has put a halt to many businesses, payday lenders and other private debt collectors still target lower-income consumers, keeping them trapped in a cycle of debt. Stimulus checks stand to be intercepted by predatory lenders, student loan debt collectors, tax preparers, bank overdraft fees, or other types of collections. Also, without sufficient protections in place, people who may already be subject to a garnishment may resort to using a check-cashing place to prevent depositing their check into an account, exposing them to greater public health and financial risk.

While the exact number of those affected by garnishments is still unclear, even without the burden of COVID-19, over half of Deep South households are unable to make ends meet for three months, if their income is interrupted.[3] Deep South states have already experienced more than 1.5 million in unemployment claims since March 15, far eclipsing the job losses of the Great Recession.[4] Lost jobs and reduced incomes due to COVID-19 are only going to exacerbate the problem of people not having enough money to cover expenses.

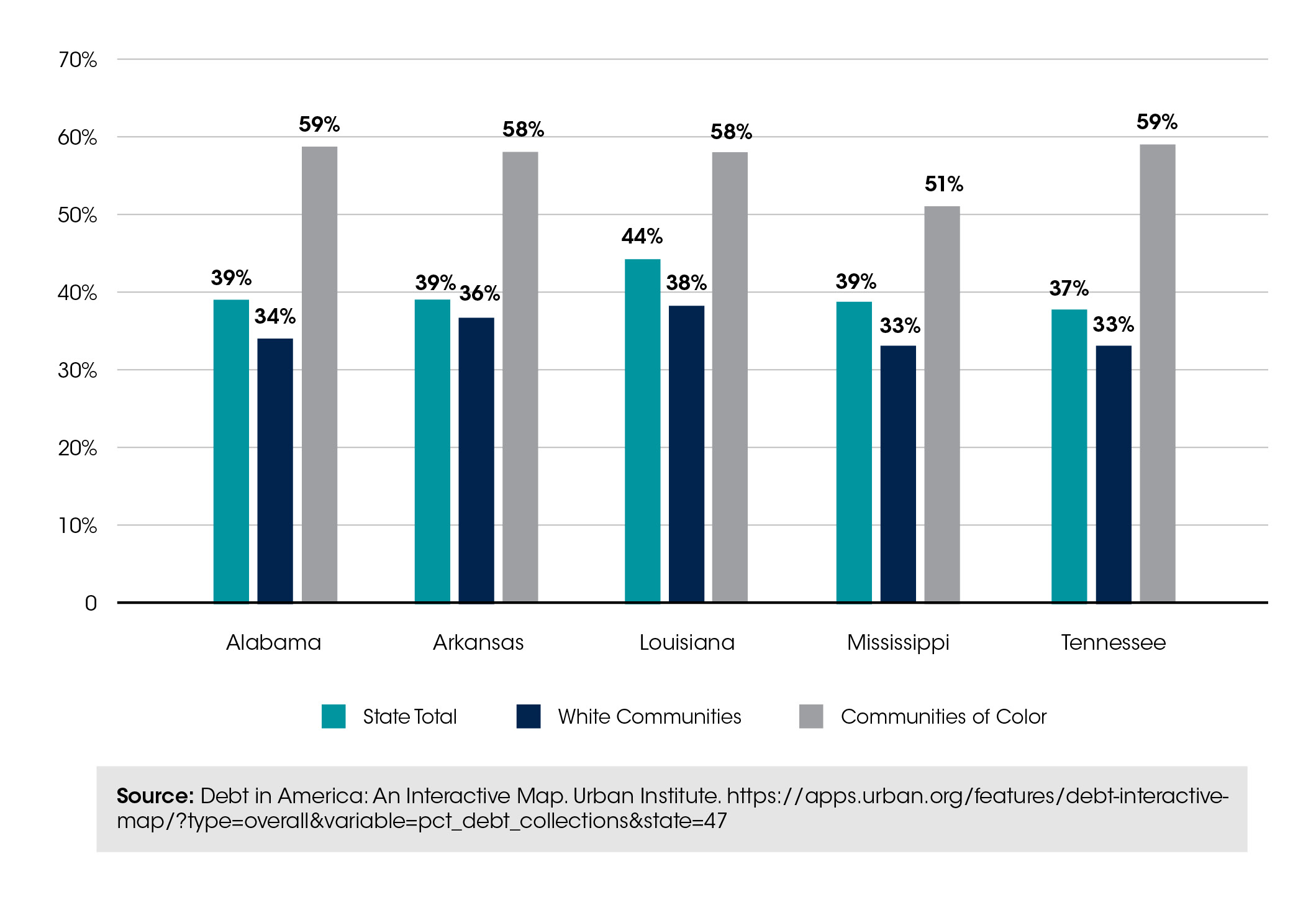

The concern is not only insufficient income to cover basic needs like food and rent, but also the amount of debt people already carry, such as medical and student loan debt. As seen in the chart below, nearly 40% of residents in each of these five Deep South states held a debt in collections before the pandemic, with that number reaching above 50% for communities of color. The number of people with debts in collections will rise significantly in the coming months.

Percent of People with Debt in Collection by State and Community

Under the CARES Act, these payments are protected from seizure for the repayment of federal or state debts, but no protection was provided for private debts. Advocates across the Deep South are encouraging their state leaders to end the seizure of stimulus checks by private debt collectors. This includes faith-based organizations, legal services providers, consumer advocates, and civil rights organizations. Last week, Mississippians petitioned the Mississippi Supreme Court to halt garnishment proceedings. In Louisiana, a broad and diverse coalition delivered a letter to Gov. John Bel Edwards asking him to take action to keep stimulus payments in the hands of Louisiana residents. Advocacy efforts are also underway in Alabama, Tennessee, and Arkansas.

These demands are in line with letters sent by attorneys general in 25 states, national financial services trade associations, and consumer advocates urging the U.S. Treasury to designate the relief payments as exempt from garnishment. The Deep South’s response continues to lag the response nationally as leaders from both political parties have taken steps to enact protections at the state level. States attorneys general in Ohio, Massachusetts, and Nebraska have acted to protect stimulus checks from garnishment. Additional actions include executive orders with debt collection protections by governors in Illinois, Iowa, and Maryland. States can use judicial and executive orders, emergency regulations, and legislation to protect stimulus payments that are meant for rent, utilities, medicine and other essential needs.

Deep South states must act urgently to ensure the CARES Act payments are not hijacked by debt collectors and serve the intended purpose to provide the essential assistance needed for households in these unprecedented times.

[1] “Treasury, IRS Deliver 89.5 Million Economic Impact Payments in First Three Weeks, Release State-by-State Economic Impact Payment Figures.” Internal Revenue Service, www.irs.gov/newsroom/treasury-irs-deliver-89-point-5-million-economic-impact-payments-in-first-three-weeks-release-state-by-state-economic-impact-payment-figures. [2] Parker, Kim, et al. “About Half of Lower-Income Americans Report Household Job or Wage Loss Due to COVID-19.” Pew Research Centers Social & Demographic Trends Project, 21 Apr. 2020, www.pewsocialtrends.org/2020/04/21/about-half-of-lower-income-americans-report-household-job-or-wage-loss-due-to-covid-19/. [3] Burt, Kiyadh. “Consumer Protection Rollbacks Will Worsen Conditions for Cash Strapped Households.” http://hopepolicy.org/blog/consumer-protection-rollbacks-will-worsen-conditions-for-cash-strapped-households/ [4] Miller, Sara. “Deep South Job Losses Due to COVID-19 Likely to Far Eclipse Those of the Great Recession.” Hope Policy Institute, hopepolicy.org/blog/sobering-estimates-of-job-losses-from-covid-19-in-the-deep-south-point-to-the-critical-need-for-targeted-economic-relief/.