Scorecard: Asset Ownership and Financial Stability in Mississippi

February 22nd, 2013

MEPC recently blogged on how well families are faring in Mississippi, according to the Corporation for Enterprise Development’s (CFED) 2013 Assets & Opportunity Scorecard. It is evident from the Scorecardthat the recession’s lingering effects have taken a huge toll on Mississippi families. Fully, 21.2 percent of state residents live in poverty and far more are financially vulnerable. The Scorecard, which takes a comprehensive look at Americans’ financial security, ranks Mississippi second to last, only behind Georgia, in asset ownership and financial stability.

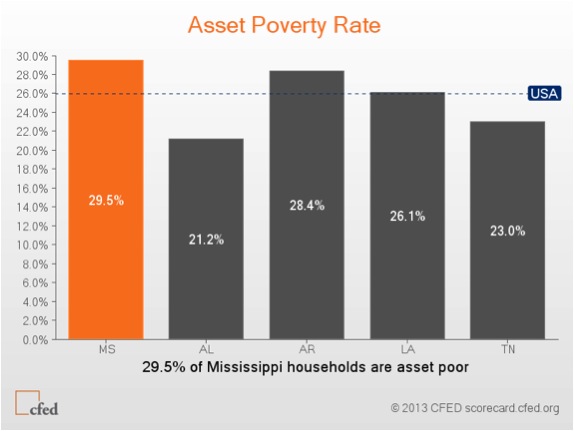

Asset poverty refers to the percentage of households without sufficient net worth to live at the poverty level for three months in the absence of income. Furthermore, asset poverty includes durable assets, such as a home or business that would need to be liquidated to cover day-to-day expenses. The Scorecard found that 26 percent of American households and 29.5 percent of Mississippi households are asset poor, meaning that the assets they do have, like a savings account or durable assets, are overwhelmed by debt (See Chart). Additionally, 17.5 percent of American households and 18.9 percent of Mississippi households are extreme asset poor, meaning that they have zero or negative net worth. Essentially, their household debt exceeds their financial assets and they have no financial cushion to weather any type of financial crises.

The high rate of asset poverty in Mississippi underscores the importance of implementing policies that promote asset accumulation, as far too many households lack the financial resources necessary to weather a financial crisis like a job loss, medical emergency or the need to fix a car. Mississippi can improve this problem by providing opportunities for Mississippians to save for emergencies and the future through appropriate financial products, services and incentives, such as Children’s Savings Accounts (CSAs). Fundamentally, CSAs are tax-favored, investment accounts that are established for children as early as birth and are seeded with an initial deposit. These accounts are built by contributions from family, friends and the children themselves to save for financing higher education, starting a small business, buying a home or funding retirement. CSAs are powerful financial tools that provide an opportunity for long-term investment in children and their families by encouraging long-term planning, building family wealth, and promoting financial literacy.

**America Saves Week 2013 begins Monday, February 25th**

As part of America Saves Week 2013, MEPC is doing a series of blogs to educate our readers on liquid asset poverty, net worth, sub-prime credit, the numbers of unbanked and underbanked in Mississippi, and ways working families can start to build assets. Join us on Policy Matters to learn more.