Building Toward Economic Mobility in Mississippi: Asset Poverty

July 5th, 2012

Low-income working families oftentimes struggle to make ends meet as they work to provide the most basic needs for their families. According to the 2012 Assets and Opportunity Scorecard, which assesses the 50 states and the District of Columbia on financial security, one in seven Americans has zero or negative net worth, meaning that many Americans do not have a sufficient net worth to live at the poverty level for three months without an income.

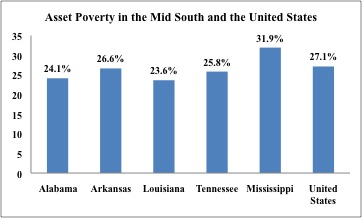

Mississippi ranks last in asset ownership and financial stability. According to the Scorecard, approximately 27 percent of Americans are asset poor, while 32 percent of Mississippians are asset poor. This leaves Mississippians among the most financially insecure and vulnerable, as many low-income working families do not have available financial resources, like money in a bank or assets in a home or car, to weather an emergency such as a job loss or medical emergency.

There are numerous policies that Mississippi can implement to improve asset building and promote financial stability in the state. As such, Mississippi should create more viable opportunities for families to build their assets for future investments through a balanced approach. The state can help Mississippians achieve greater self-sufficiency by enacting tax credits for low-income working families, creating a state Individual Development Account program, and further enhancing protections from the relatively high fees associated with payday lending and auto title loans.

Source: CFED, Assets and Opportunity Scorecard, 2012.