CDFIs and MDIs Continue to Cater to Small Businesses Despite PPP Barriers

July 23rd, 2020

The Small Business Administration (SBA) recently released detailed data on the Payment Protection Program (PPP), the $600 billion federal relief effort for businesses amidst the COVID pandemic. The data release includes loan amount, name of lender, NAICS code, demographic data, and for loans above $150,000, also the business name and addresses. Well-capitalized businesses received significant funds, often in the millions, while smaller firms without strong relationships with financial institutions faced difficulty in accessing relief. SBA data reveal that loans from $1 million or greater represent just over a third (34.8%) of total deployed PPP funds.[1] Franchised businesses and other businesses with greater access to capital were able to retrieve a PPP loan, often through banks while structural barriers with the PPP program led to small businesses, such as sole proprietors and businesses owned by people of color, being disproportionately locked out from accessing funds.[2] Two entities that stood in the gap for small businesses in need were Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs). MDIs include banks and credit unions owned by people of color.

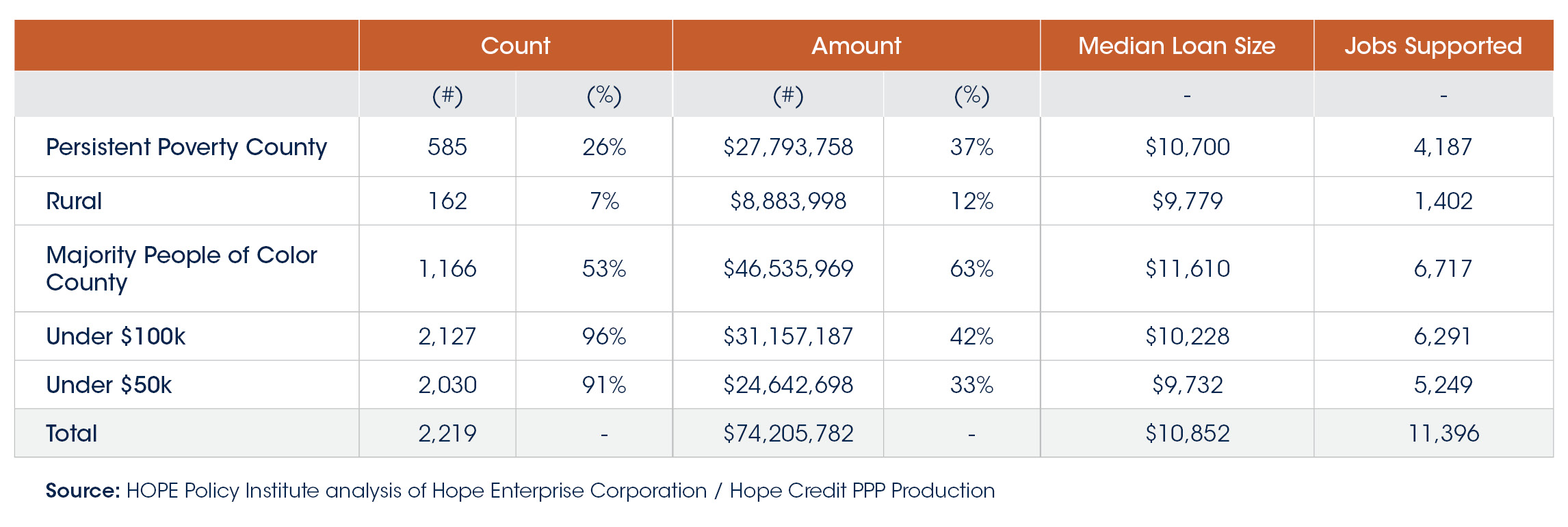

CDFIs and MDIs, like HOPE, were able to utilize their strengths to cater to the financial needs of small businesses in distressed communities. CDFIs and MDIs have outperformed other PPP lenders in providing relief to small businesses. According to the SBA, they have deployed over $16 billion assisting approximately 200,000 businesses with an average loan size of $77,826. By comparison, financial institutions with more than $50 billion in assets deployed approximately $190 billion, nearly 36% of total PPP funds deployed, with an average loan size of over $115,000. See Table 1.

Table 1: CDFI and MDI PPP Lending Compared to Large Lenders, as of June 30, 2020

Source: United States Small Business Administration. “Payment Protection Program (PPP) Report: Approvals through 06/30/2020”. https://www.sba.gov/sites/default/files/2020-07/PPP%20Results%20-%20Sunday%20FINAL-508.pdf

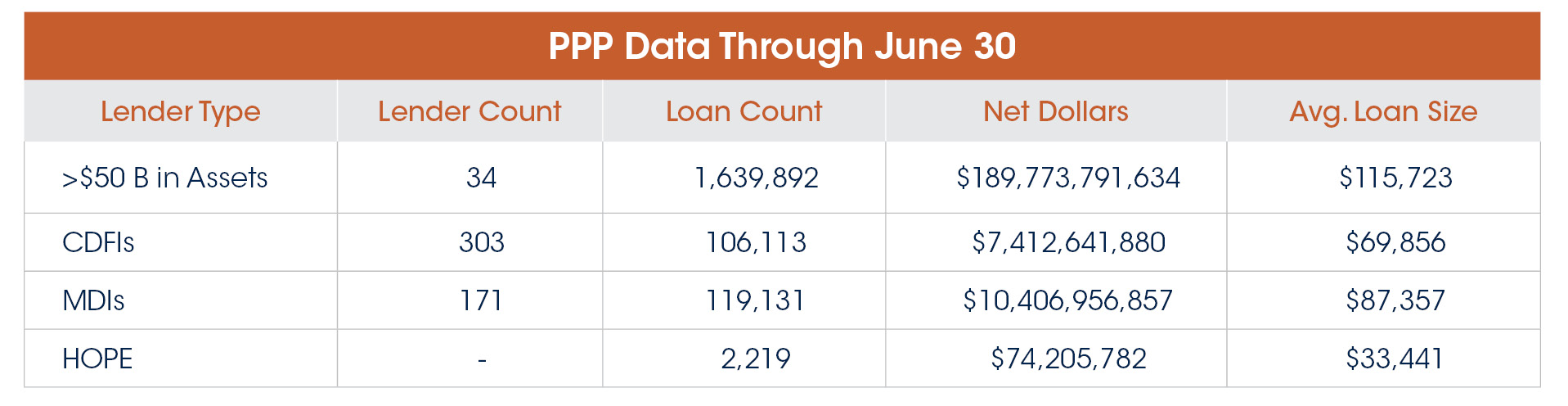

HOPE, as of June 30, 2020, closed 2,219 loans for a total of over $74.2 million with an average loan size ($33,441) significantly lower than its counterparts. Over half of HOPE’s PPP loans went to businesses located in counties where the majority of residents were people of color, and these loans represented over 60% of HOPE’s PPP funds. The overwhelming majority of loans closed have been for relatively small businesses. The majority (96%) of loans closed were also under $100,000 and the bulk of those (90%) were under $50,000. Just over one out of every four businesses assisted was located in a persistent poverty county, where the poverty rate has exceeded 20% for thirty years. Overall, HOPE has been able to direct dollars to support the stabilization of over 11,300 jobs in economically distressed regions across the South. See Table 2.

Table 2: HOPE’s PPP Lending of 06-30-2020

HOPE has played a critical role in supporting sole proprietors, despite these businesses not being served in the first round of the program as billions of dollars flowed to larger companies. Given that over 90% of Black and Latino owned businesses are sole proprietors, businesses owned by people of color were disproportionately affected by this barrier in the PPP program.[3] Within HOPE’s lending, nearly four in ten business owners (38%) identified as sole proprietors or self-employed.

HOPE’s experience with PPP underscores the impact of CDFIs and MDIs to reach underserved populations. As federal and state relief programs continue, CDFIs and MDIs should be included in relief strategies to ensure resources reach hardest hit, financially vulnerable, people and communities.

[1] United States Small Business Administration. (2020). “Paycheck Protection Program (PPP) Report: Approvals through 06/30/2020”. July 06, 2020. https://www.sba.gov/sites/default/files/2020-07/PPP%20Results%20-%20Sunday%20FINAL-508.pdf. Accessed July 16, 2020. [2] Kiyadh Burt. (2020). “Despite Changes in Second Phase of PPP, Many Small Businesses Remain Locked Out”. May 8th, 2020. http://hopepolicy.org/blog/despite-changes-in-second-phase-of-ppp-many-small-businesses-remain-locked-out/. [3] Center for Responsible Lending. (2020). “The Paycheck Protection Program Continues to be Disadvantageous to Smaller Businesses, Especially Businesses Owned by People of Color and the Self-Employed”. April 6, 2020. https://www.responsiblelending.org/sites/default/files/nodes/files/research-publication/crl-cares-act2-smallbusiness-apr2020.pdf?mod=article_inline. Accessed July 16, 2020.