Centering the Experiences of Women is crucial to Increasing Financial Stability

June 13th, 2023

By Courtney Thomas, Senior Policy Analyst

Financial literacy is central to building generational wealth. Understanding money and having access to money management tools can help avoid high-cost debt, pay off bills, and save for the future. Historically, women have experienced discrimination in accessing financial services, and today, the financial realities of women and men differ greatly. Women are more likely to be financially vulnerable, feel less secure about their finances, and carry higher burdens of debt than their male counterparts.[1] In times of economic uncertainty, working women are undoubtedly hit the hardest. Their experiences, however, can shape policy recommendations for more equitable financial inclusion efforts.

The Aspen Institute released a new report titled Women in the Economy: Lifting up Women’s Voices, Wisdom and Experience to Build a Gender-Equitable Economy, which highlights the unique challenges that women face during times of economic hardship. Drawing on the lived experiences of over one thousand women, the report uplifts policy solutions that aim to improve the financial status of women in the economy.

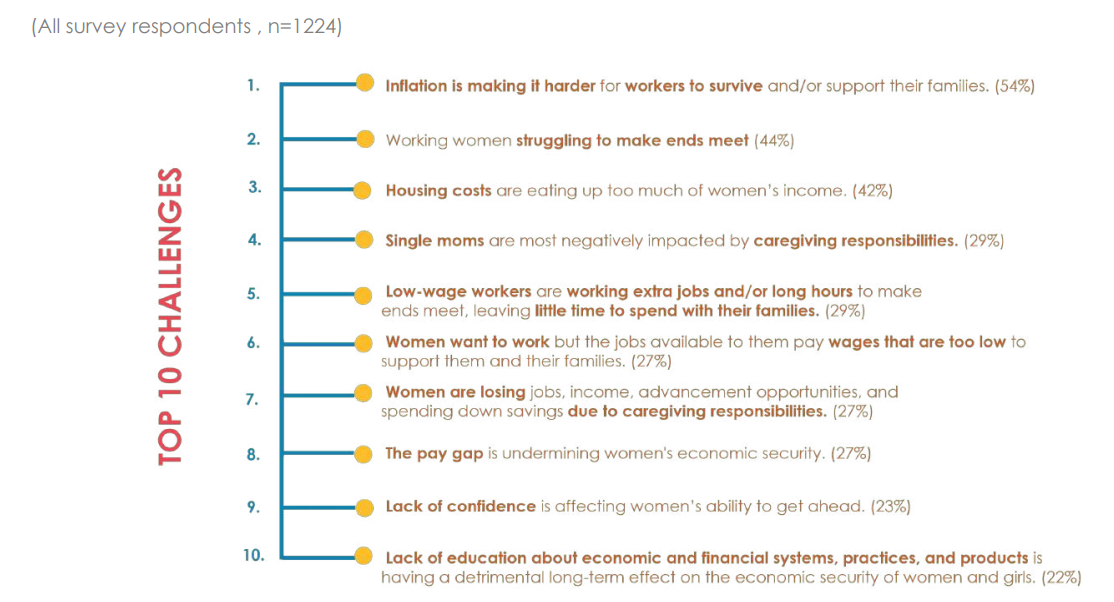

The major challenges mentioned by all women centered around three main themes, cash flow crisis, the financial penalty of child and dependent care services, and gender and racial discrimination in the workplace. Across race and ethnicity, 90- 100% of all respondents indicated that financial challenges such as inflation, rising housing costs, and the struggle to make ends meet were of the most concern.[2]

Top Ten Challenges for All Women in the Economy

Source: Women in the Economy, Financial Security Program, Aspen Institute 2023

As a Black and women-owned financial institution, HOPE understands the challenges women face. The rising costs of goods and services are making it increasingly more difficult for women to support their families—especially on limited incomes. Consequently, households are more likely to overdraft checking or savings accounts, incur high-cost debt such as payday loans, or go without spending on household utilities or groceries.

Challenges are more acute for Deep South households, which have the highest rates of liquid asset poverty in the country. Over one-third, (33%) of Alabama households are unable to cover typical household expenses for three months in the case of job loss or financial crisis.[3] The financial burden tends to be tougher for Black families who traditionally have had less access to wealth. For example, 55% of Black households had difficulty paying for usual household expenses as compared to 27% of white households in Alabama.[4]

The Women in Economy Report calls for solutions that will prioritize women and their distinct experiences—taking into account their racial background, culture, age, and abilities. Similarly, HOPE takes a nuanced approach in addressing financial barriers of working women in the Deep South. HOPE addresses these structural problems through people, place, and products. Over 60% of HOPE’s members are women. Eight out of ten HOPE branches are located in majority Black communities, and 64% of HOPE’s lending is to black owned businesses.

Nonetheless, efforts to increase financial inclusion for women will require a collaborative approach among financial institutions, employers, and policymakers. Stakeholders must aim to dismantle systems that perpetuate inequities and design policies that benefit all women – especially those most marginalized. The report provides solutions on how to increase equity and financial mobility for women.

Close the Gender Pay Gap

An economy that works for women ensures that women receive equal pay for equal work. The wage gap among men and women persists throughout the United States but is especially prevalent among women of color. White women make 79 cents on the dollar compared to white men, while black and Latina women make 63% and 58%, respectively. [5]

Create Affordable and Accessible Childcare

Over one-quarter of families (28%) in the Deep South are single woman-headed households.[6] The cost of child and dependent care unequally affects women-headed households who are twice as likely as other households to have children under 18 at home.[7] When women have access to affordable and quality childcare, they are able to participate enthusiastically in the labor force, increase productivity in the workplace, and foster long-term economic growth. [8]

Promote Women in Leadership

When women are empowered, everyone benefits. Studies show that women leaders are stronger champions for diversity and equity, increase employee retention, and support the overall well-being of employees.[9] Despite these advantages, women are underrepresented in leadership positions. The Government Accountability Office found that women made up 42% of executives across industries, despite making up 48 % of the workforce. [10]At HOPE, 62% of women are in management positions and 72% of associates are women.

[1] Warren Andrew, Jess McKay, Meghan Greene (2022). The Gender Gap in Financial Health, Financial Health Network https://finhealthnetwork.org/research/gender-gap-in-financial-health/

[2] Mcculloch Heather and Celine Apollon (2023). Women in the Economy (WE) Lifting up women’s voices, wisdom and experience to build a gender-equitable economy

https://www.aspeninstitute.org/wp-content/uploads/2023/03/Women-in-the-Economy-Survey-Findings-compressed.pdf

[3] Prosperity Now Scorecard. (2021). “Financial Assets & Income Liquid Asset Poverty Rate”. https://scorecard.prosperitynow.org/data-by-issue#finance/outcome/liquid-asset-poverty-rate

[4] Prosperity Now Scorecard Arkansas : Financial Assets & Income- Data by issue- Difficulty Paying Usual Household Expenses Chart https://scorecard.prosperitynow.org/data-by-issue#finance/outcome/difficulty-paying-for-usual-household-expenses

[5] Miller, Sara (2023). The Wage Gap, Homeownership, & Economic Mobility

http://hopepolicy.org/blog/the-wage-gap-homeownership-and-economic-mobility/

[6] Hope Policy Institute analysis of data from the U.S. Census Bureau, American Communities Survey 2022 estimates (Table S1101)

[7] Miller, Sara (2023). The Wage Gap, Homeownership, & Economic Mobility

http://hopepolicy.org/blog/the-wage-gap-homeownership-and-economic-mobility/

[8] World Bank Group (2022). Women in Business and Law “ Toward Available, Affordable, and Quality Childcare Services.” https://wbl.worldbank.org/en/childcare

[9] Mckinsey and Leanin.org (2022). Women in the Workplace 2022 https://leanin.org/women-in-the-workplace

[10] Government Accountability Office (2023). Women in the Workforce: Underrepresentation in Management Positions Persists, and the Gender Pay Gap Varies by Industry and Demographics

https://www.gao.gov/assets/gao-23-106320.pdf