Check Cashers Charge More in Mississippi than in Any Other State in the Region

September 8th, 2010

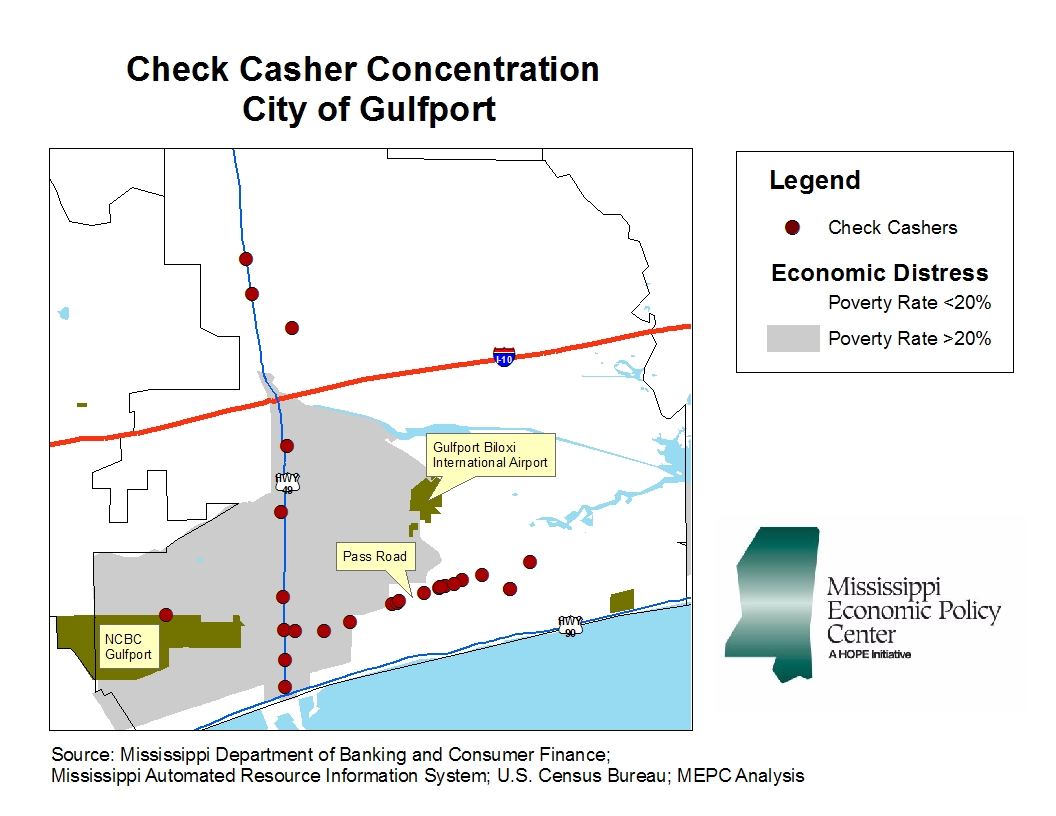

Payday loans are advertised as providing solutions to individuals that are temporarily unable to make ends meet due to certain circumstances. However, the high-interest rate and short-term repayment cycle of payday loans often lead the borrower to taking on additional loans and paying even more fees – often exceeding the initial amount of the loan. Payday lenders also tend to locate in or near high-poverty areas as seen in the map below of Gulfport, Mississippi.

Click to enlarge

Check Cashers, who also can offer payday loans, in Mississippi have a special legislative exemption from state usury laws, which allows them to charge more to Mississippians than in any other state in the region. The uneven playing field for the check cashers allows them to charge significantly more than the 36 percent interest rate cap required by banks, credit unions, and finance companies. It also means Mississippians are paying more than working families across state lines.

To address the disparities created by the legislative exemption, reform is needed of this industry in our state.

Author:

Antwyn Brown, Policy Analyst