DAY 4 OF BUDGET HEARINGS: Recession Has Impacted the Public Employees Retirement System, Potentially Affecting Resources Available for Retirement

September 23rd, 2011

The final day of budget hearings began with the Public Employees Retirement System (PERS). The post below details key facts about the individuals served by the agency and summarizes a number of concerns about the sustainability of the system that was discussed in the hearing.

Key Facts Provided by PERS

- The average annual benefit for retired public employees was $19,256 in Fiscal Year (FY) 2011 for individuals with 22 years or more of public service.

- The system currently adjusts each retiree’s benefits for the cost of living to ensure that they have the ability to maintain basic economic security. Without this cost of living adjustment (COLA), the average benefit would be lower, at $15,000 annually.

- Last year, retirement benefits allocated by the state totaled $1.8 billion.

- New employees contribute 9 percent of their income to retirement each year, one of the higher rates among states that also contribute to Social Security, according to Director Robertson.

- In 2011, 85,849 retirees were members of PERS and, 163,335 active members were covered by plans PERS administers. The number of active members has decreased two years in a row, from 167,901 in 2009, as state and local employment declined during the downturn.

Cost of Living

We learned Monday that 62 percent of the employees under the State Personnel Board’s purview earn less than $34,279 a year. With average incomes at $34,279, many adults may struggle to save beyond their contributions to retirement plans. As a result, it remains important that the resources provided through their retirement plans are adequate to fulfill their basic needs throughout their retirement. Director Robertson stated that the 3 percent COLA that retirees receive is vital to ensuring public employees receive long-term economic security throughout their lives.

Employer Contributions

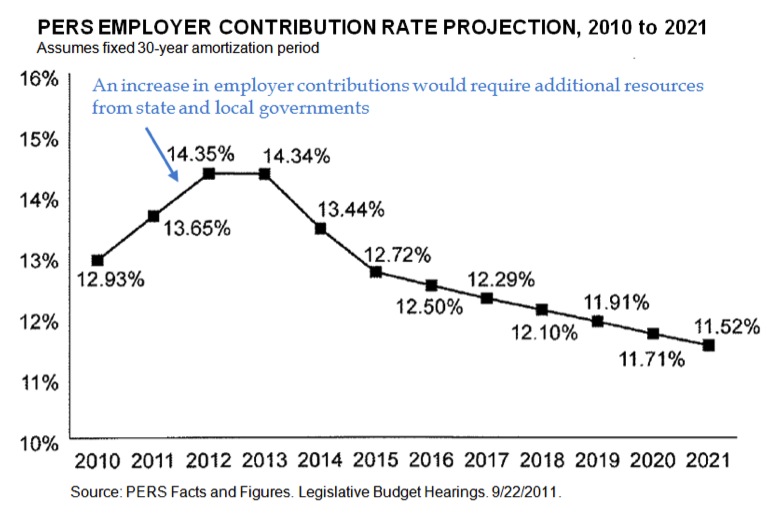

As the figure below shows, PERS projects that there may be a need for additional employer contributions to retirement plans over the next couple of years. Contributions would grow 1.4 percent, from 12.93 percent to 14.35 percent. An upward adjustment in employer contributions would mean that state agencies and local governments would need to set aside additional resources for retirement contributions that may not be included in their budgets.

Click to enlarge

In the months and years ahead, state and local governments are projected to need additional resources to contribute to the retirement of their employees. Without additional revenue, many agencies may struggle to meet those demands, building on the need for financial resources among state and local governments. This underscores that approaches considering pathways to generate revenue can impact the economic security of all residents across all age ranges in Mississippi communities.