Loan Splitting: How an Emergency Loan Can Become a Debt Trap

January 24th, 2011

On Friday, January 21, the Mississippi Senate enlarged a loophole in the original version of the House payday lending reauthorization legislation.

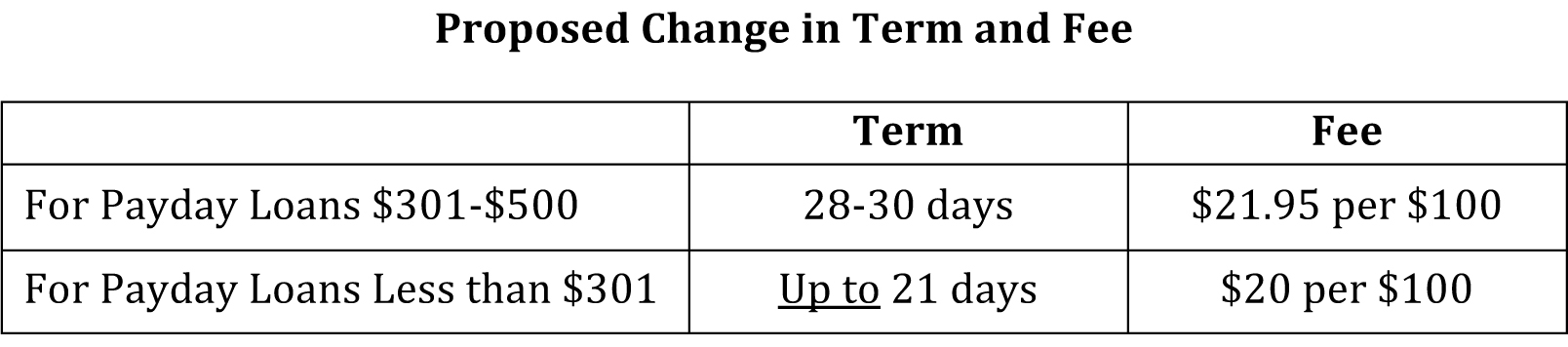

Despite efforts to increase consumer protections by implementing a 28 day repayment period on larger payday loans, the current bill’s payday lending provisions allow lenders to get around the 28-day repayment term through a process called loan splitting. The table below illustrates the proposed changes to payday loan repayment terms:

Click to enlarge

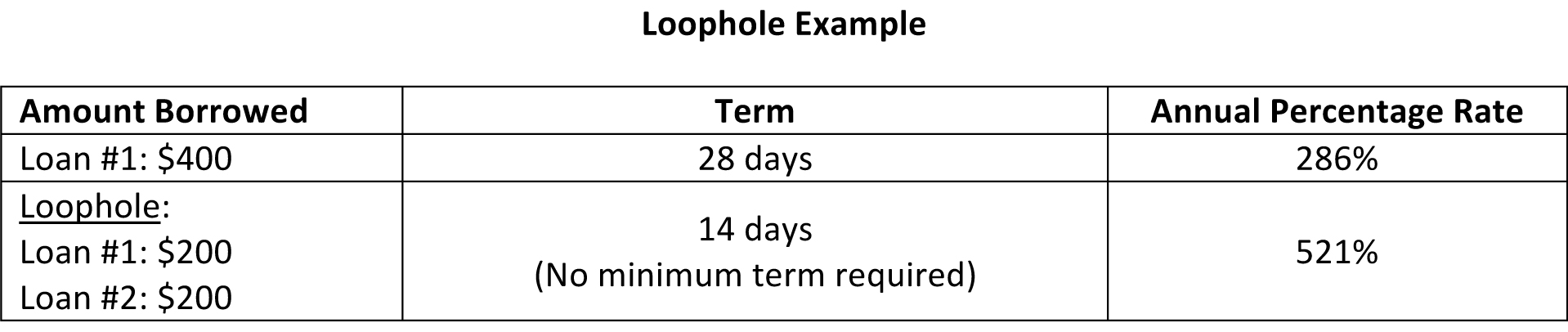

The “up to” language for smaller loans allows the loophole to exist:

Click to enlarge

While the fees paid on the two loans would drop slightly, the consumer protection provision of a 28-30 day repayment term is easily circumvented. While there has been some discussion of a regulatory ruling requiring that multiple loans taken out simultaneously be considered one loan, Mississippi lacks the infrastructure to enforce this ruling at the time the loans are made.

To enforce this law and to prevent borrowers from taking out multiple loans beyond legal limits, a statewide system, or database, is the single-most effective way to prevent emergency loans from turning into debt traps. Thirteen (13) states already use a statewide system to enforce responsible lending.