Medical Debt in the Mississippi Delta

November 18th, 2020

By: Diane Standaert, Calandra Davis, and Sara Miller

Though it is not visible in a drive through the backroads of the Mississippi Delta, medical debt is casting an oppressive shadow over the people and communities there. Nationally, medical debt and related collection abuses disproportionately impact Black communities, and stifles economic opportunity. This is of particular concern for Delta towns, where a history of discrimination and exclusionary policies, have led to high levels of economic distress, thus exacerbating both the burden and consequences of unaffordable debt. These conditions underscore the importance of policy solutions that provide debt relief, and increase concern about a recent rule by the Consumer Financial Protection Bureau (CFPB) that will codify harmful debt collection protections.

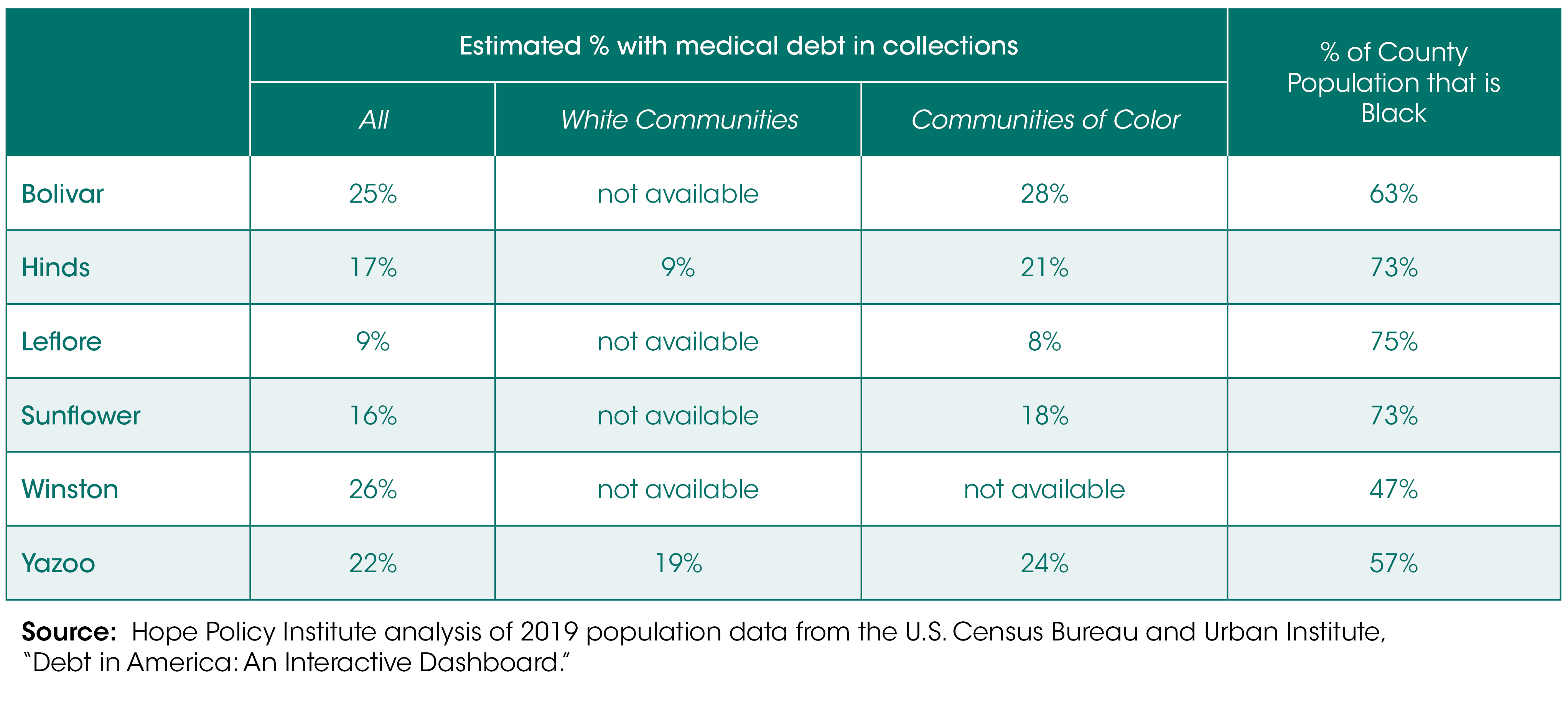

According to data by the Urban Institute, in Bolivar County, MS, one in three people in communities of color have a medical debt in collections, while white communities have significantly less. Similar patterns are found across the Delta. In Sunflower County, where 73% of the population is Black, one in three people living in communities of color have a medical debt in collection. In contrast, the level of medical debt collection in white communities is so low that it is not measurable.

Table 1: Medical Debt in Mississippi Delta Counties

Defaulting on medical debt damages people’s credit score, thus resulting in a higher cost of credit from consumer loans to home loans. This added cost is on top of the emotional and psychological burden of both the debt and the abusive tactics of debt collectors. In the midst of COVID, it must also be viewed within the context of the disproportionate economic impact of the pandemic on Black communities: the loss of income coupled with high debt amounts put people in jeopardy of not being able to pay for basic needs such as rent, groceries, or utilities.

These disparities and consequences underscore the urgency of policy reforms supporting medical debt relief and protections against abusive debt collection protections. “I felt like I was able to breathe,” said Tina Moore, in Shelby County TN, after $2,400 of her medical debt was forgiven last year. Her debt was forgiven when Methodist Le Bonheur Healthcare facility forgave $11.9 million due to criticism of their collection practices.1

Research shows how debt forgiveness increases one’s opportunity for economic mobility, such as finding employment with greater income and preventing defaults on other accounts.2 Amidst COVID specifically, data from the Federal Reserve show over 43% of Black and Latino people found suspensions of debt relief payments and negative credit reporting to be a beneficial part of COVID financial relief efforts.3 Another Federal Reserve report published in May found prior to the crisis, seven Southern states, including all the states in our footprint, held the highest delinquency rates for consumer debt in the country (auto loans, student loan, credit card debt). These findings lead the researchers to conclude that COVID-relief beyond just mortgage payment relief may be particularly important for regions such as the South.4

Despite the documented harms of unfair debt practices, and the benefits to providing economic relief from such debt, the Consumer Financial Protection Bureau has finalized one part of federal regulations that does not yet do enough to protect consumers. As just one example, the CFPB finalized one part of its rule, debt collectors will be able to, for use emails, text messages, and social media private messages.5 Unless adequately addressed with debt collection protections or debt relief, medical debt deepens existing disparities in places like the Mississippi Delta, stifling economic opportunity for local people and communities.

1Thomas, W. (2019, December 24). Methodist Erased $11.9 Million in Hospital Debt For Thousands. Here Are Four Stories. https://mlk50.com/methodist-erased-11-9-million-in-hospital-debt-for-thousands-here-are-four-stories-cd6ef6ceb560

2Maggio, M., Kalda, A., & Yao, V. (2019, September 7). The effects of debt relief on the student loan market. https://voxeu.org/article/effects-debt-relief-student-loan-market

3Akana, T. (2020, June). CFI COVID-19 Survey of Consumers: Federal Reserve Bank of Philadelphia. https://www.philadelphiafed.org/-/media/covid/cfi/cfi-covid-19-survey-of-consumers-wave2-updates.pdf

4Famiglietti, M., & Garriga, C. (2020, May 13). Ready for the Pandemic? Household Debt before the COVID-19: Federal Reserve Bank of St. Louis. https://www.stlouisfed.org/on-the-economy/2020/may/ready-pandemic-household-debt-covid19-shock

5National Consumer Law Center, Press Release, “CFPB Debt Collection Rule a Mixed Bag for Consumers,” Oct. 30, 2020, https://www.nclc.org/media-center/cfpb-debt-collection-rule-a-mixed-bag-for-consumers.html