Mississippi Has Highest Rates of Unbanked and Underbanked – 2013 FDIC Survey

December 5th, 2014

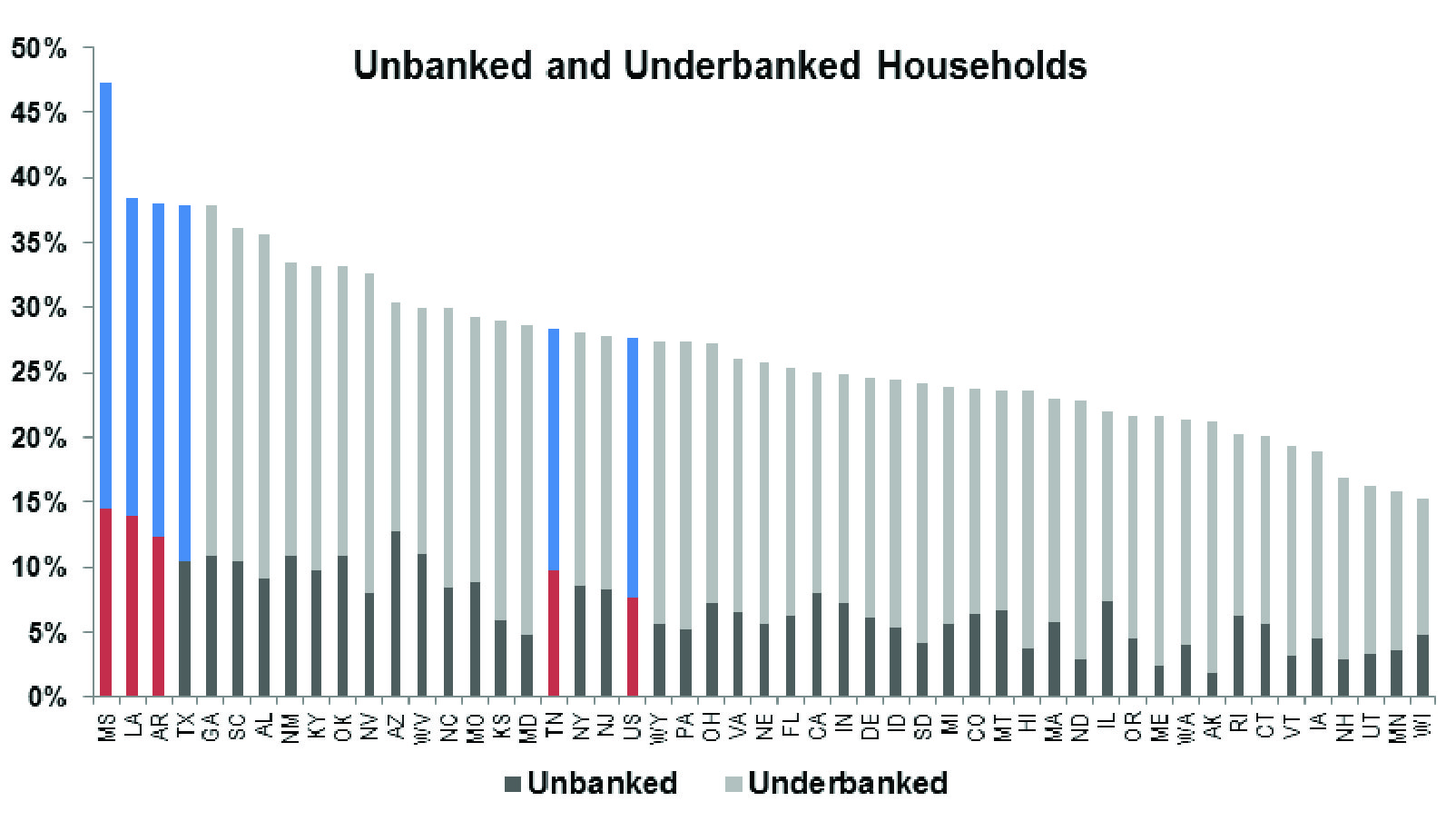

People who have an account with a bank or credit union are better positioned to participate in the economy and contribute to the nation’s recovery. However, a large number of American households do not have access to basic financial tools like checking and savings accounts. According to the 2013 FDIC National Survey of Unbanked and Underbanked Households, more than one in four households (27.7%) are either unbanked or underbanked. Unfortunately, Mississippi leads the nation in the number of unbanked and underbanked households. A relationship with a financial institution enables individuals to more securely plan for future investments as they work their way toward financial stability. Banks and credit unions allow people to save their income to purchase a home, start a business, or further their education.

The Unbanked – have no checking or savings account.

In the United States, one in thirteen households is unbanked. Mississippi has the highest percentage of unbanked households in the country, followed by Louisiana and Arizona. Approximately 14.5% of households in Mississippi are unbanked. See Chart.

The Underbanked – have an account but continue to depend on costly alternative financial services for basic transactions and credit needs, like check cashers, payday loan providers, pawn shops, auto title lenders and rent-to-own stores. These businesses charge high fees for their services – services that deplete rather than preserve income and wealth. In the U.S., one in five households is underbanked. Mississippi also has the highest percentage of underbanked households in the country – 32.8% of households in Mississippi are underbanked (a nearly 10 percentage point increase from 2011). Compared to the rest of the nation, Texas and Georgia have the second and third highest rate of underbanked residents in the country (approximately 26% and 27%, respectively). See Chart.

Unbanked and underbanked households typically operate in a cash-based system, and, as a result, do not have the same financial security and opportunities as those who bank with traditional financial institutions. The unbanked and underbanked are more likely to spend a percentage of their net income on unnecessary fees. They are also more likely to be victims of crime, because they often carry their cash or keep cash in their homes.

The new data continue to underscore the importance of implementing policies that promote financial inclusion. When households are attached to the financial mainstream, they have the tools available to save and build wealth, as well as the opportunity to pass good financial habits onto children.

Interestingly, the states with the highest rates of unbanked populations are those states with large immigrant and African American populations. For example, one out of three African American households in Mississippi is unbanked – approximately 10 percentage points higher than the national average for African Americans. Given the shifting demographics of the country, pursuing policies that support successful models of connecting households of color to the financial mainstream remains essential to maximizing opportunity in America. Examples of such policies include expanding support for Community Development Financial Institutions and Community Development Credit Unions to continue the work of meeting the needs of historically underserved populations.

Source: FDIC, 2013 FDIC National Survey of Unbanked and Underbanked Households, 2014