New Tax Plan Would Compromise Funding for Schools and Roads; Largely Benefits Corporations and the Wealthy

March 17th, 2015

A new tax cut plan, proposed by Lt. Governor Tate Reeves, has passed the Senate and will now be considered by the House. The plan, announced by Lt. Governor Reeves on March 16, includes his original plan and adds more individual income tax cuts. The proposal is another example of drastic tax cuts that would largely benefit corporations and wealthy Mississippians. It would cost an estimated half a billion dollars and would erode our ability to support schools, universities, roads and bridges—all areas that are starving for investment. These tax cuts will undermine our future by making it harder to invest in what makes Mississippi’s working families productive.

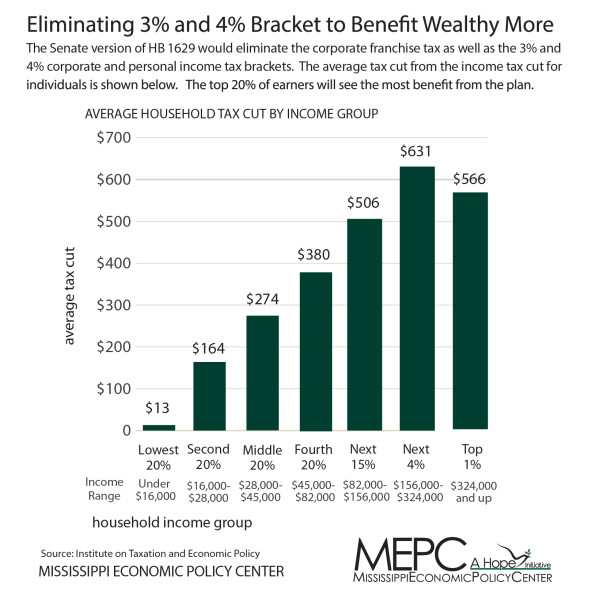

The plan includes eliminating the corporate franchise tax as well as both the 3% and 4% corporate and personal income tax brackets and adding a self-employment tax deduction.

- It would cost over half a billion dollars ($550 million) when fully implemented

- Forty-five percent (45%) fo the cut would benefit corporations

- Only one-third (1/3) of the individual tax cut would go toward low- and middle-income earners

The high cost of big tax cuts may require Mississippi to raise revenue in the future through higher sales and property taxes, both of which hit lower- and middle-income earners hard. The result will be worsening schools and roads and a tax shift away from the wealthy and onto lower- and middle-income families.