TAX CREDITS FOR PRIVATE SCHOOL TUITION: THE WRONG APPROACH FOR MISSISSIPPI STUDENTS

January 31st, 2013

A piece of legislation moving through the Mississippi House would set aside $10 million in public tax revenue for funding private school tuition. The $10 million for private school subsidies would be supported by tax credits to individuals or businesses who contribute to an organization providing private school scholarships. Students eligible for the scholarship would be those living in an attendance zone for a low-performing school that are either enrolled in a public school or entering kindergarten.

MEPC has several concerns about the legislation as it moves forward in the House after passing the Education Committee on January 30th. The Center’s concerns for HB906 include:

- The proposed tuition tax credit takes state tax dollars from chronically underfunded public schools to pay for private school tuition.

Last year alone, Mississippi underfunded public education by $259 million. This proposal further pulls resources that would be available to struggling public schools to cover the cost of teacher assistants, books, and other critical needs. The proposal takes $10 million that could be invested in public education and diverts it to private schools through tuition scholarships.

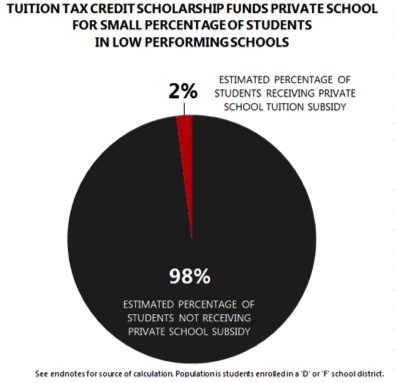

- The proposed tuition subsidy provides funds for a small fraction of the students currently enrolled in low performing schools and leaves students that remain with fewer resources.

A better approach would be using the $10 million to make targeted investments in these public schools, so all students potentially benefit. Several proposals before the Legislature make investments in literacy training for students, in pre-kindergarten and in scholarships for teacher training. These proposals stand to advance the quality of public education for all students, and targeting resources toward these proposals is a more effective approach than allocating $10 million to private schools.

The funds for private school tuition would support scholarships for approximately 2% of the students currently enrolled in a low performing¹school district.² This means less than 1 student in every classroom has the potential to receive scholarship funding, leaving thousands of students in struggling schools.

- The proposal would reduce tax revenue to support private schools with limited indication of quality.

Mississippi has invested great time and resources in developing a high quality rating system for public schools, so parents can compare schools and monitor their quality. Private schools are not rated by the same standards. This lack of rating for private schools means that $10 million in public tax dollars could be used to support private schools of unclear quality with uncertain benefit to students. Evidence is mixed at best on whether subsidizing private school tuition improves academic outcomes of students.

- The proposed income cap for scholarship eligibility could leave the state vulnerable to paying tuition for students already planning to attend private school.

HB906 proposes that families living on income below 250% of poverty living in an attendance zone for low-performing schools are eligible for private school tuition scholarships. A Mississippi family of 4 at 250% of the poverty level earns $57,625 per year. Families at this income level may have the resources to cover private school tuition for a child. The income cap leaves Mississippi vulnerable to subsidizing private school tuition for children entering kindergarten that already planned to attend private school. Paying tuition for students that already planned to attend and pay for private school would be inefficient and costly to the state. Additionally, the proposal would then pull resources away from students already attending poor performing schools rather than making targeted investments in supporting their education.

CONCLUSION: Mississippi faces several years of underfunding public education by hundreds of millions of dollars. These proposed tax credit scholarships would transfer $10 million away from public schools to subsidize private school tuition for a small percentage of Mississippi students. This is the wrong approach for Mississippi’s children and the wrong approach for strengthening public education for all students. A better approach is increasing investments in broader strategies that increase literacy, early childhood education and teacher quality for all Mississippi students.

Author: Sarah Welker, Policy Analyst

¹Low-performing is defined as a ‘D’ or ‘F’ school. HB 906 specifies that eligible students for the scholarship must attend a ‘D’ or ‘F’ rated school districts or be a entering kindergartener that lives in an attendance zone for a ‘D’ or ‘F’ school to receive a private school scholarships.

²MEPC calculates number of the students in ‘D’ or ‘F’ schools that would receive scholarships funding based on the $9.3 million available for scholarships each year divided by the estimated value of the scholarship per student. MEPC estimates the value of the scholarship at 90% of the state per pupil expenditure in 2011 of $4,101 as specified in HB906. Based on this calculation approximately 2,576 students could receive a scholarship compared to the 114,000 eligible students that currently attend a ‘D’ or ‘F’ school. The student enrollment of 114,000 was stated during the House Education Committee meeting on January 30. Other estimates site 2,200 students would be eligible, further decreasing the percentage of students receiving the funds.