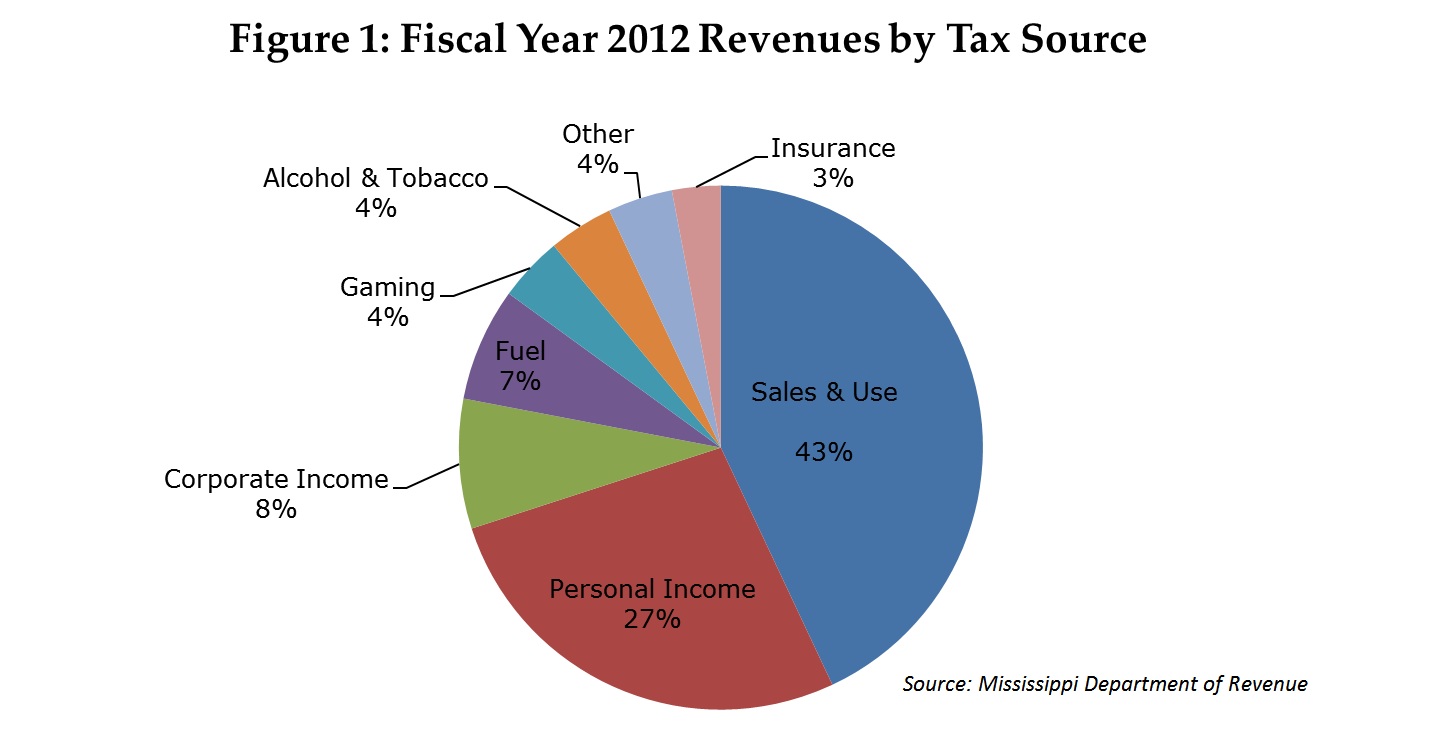

In Fiscal Year 2012, the personal income tax accounted for 27% of all revenue collected by our state—making it the second largest of eight categories shown in Figure 1, below.

The personal income tax is one of our state’s more important taxes because it asks citizens to contribute to the cost of government services based on their ability to pay—thus, making the personal income tax one of the more progressive taxes in our state. And while it is one of the more progressive taxes – it could be improved by adding another tax bracket on top of the brackets that already exist. This type of change would generate new revenue and take more into account a family’s ability to pay the tax.

In order to build a strong economy, our state needs quality schools and pre-schools, affordable colleges and universities, and effective job training programs to create the highly skilled workforce that can help businesses thrive and enable hard working people to support their families. Our taxes provide the building blocks of job creation and economic growth—without them, we limit Mississippi’s opportunities and undermine our own prosperity. .

To learn more about how taxes are used in our state, check out the Nuts and Bolts of the Mississippi Budget: A Taxpayer’s Guide to the Mississippi Budget.

You can read more about other revenue options for Mississippi in this Fact Sheet.

Author: Francinia McKeithan Henry, Policy Analyst/ SFAI Policy Fellow