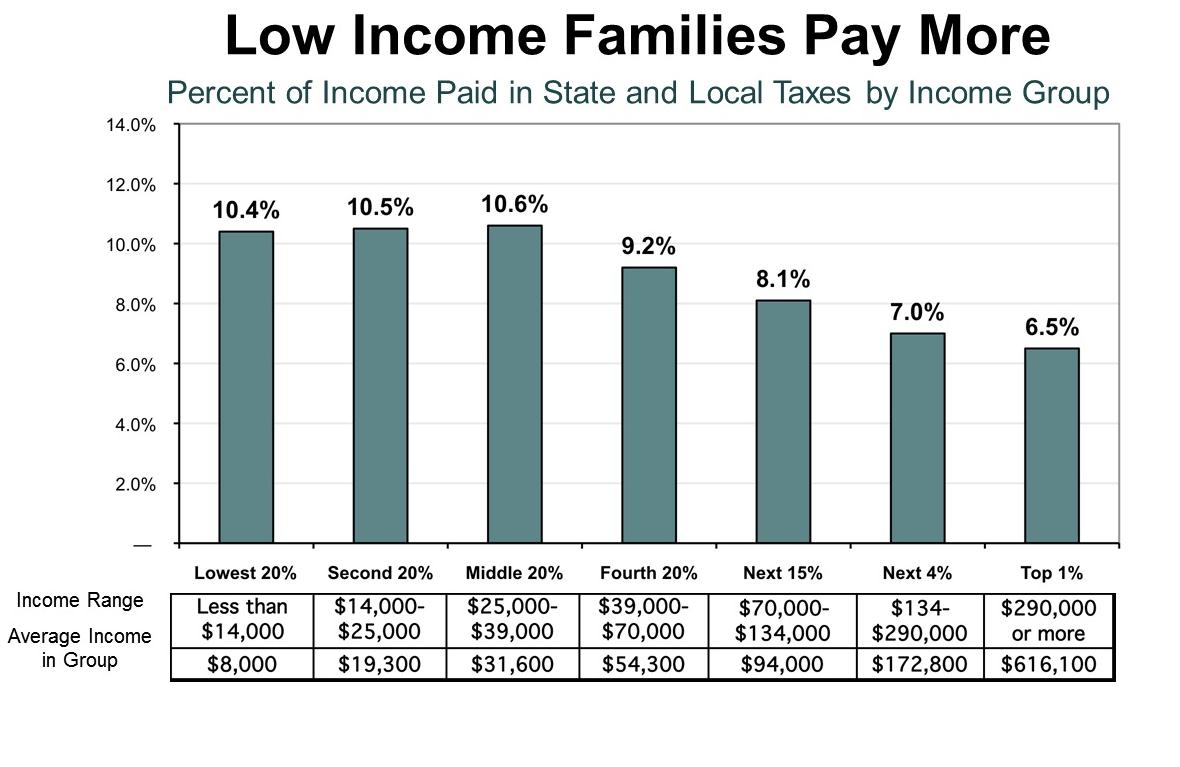

As shown in the chart below, we ask low income families to pay over 10 cents out of every dollar they earn in state and local taxes, while the wealthiest households pay just 6.5 cents out of every dollar of income. For low income families, that 10 cents means they have less to spend on necessities.

Source: MEPC analysis of data from Institute on Taxation and Economic Policy

Source: MEPC analysis of data from Institute on Taxation and Economic Policy

The tax system asks more of low income families due to its heavy reliance on the sales tax. The sales tax is levied without taking into account a family’s ability to pay. Furthermore, lower income families spend a larger portion of their income on goods that are subject to the sales tax, especially because we are one of only two states to extend our full sales tax includes groceries.

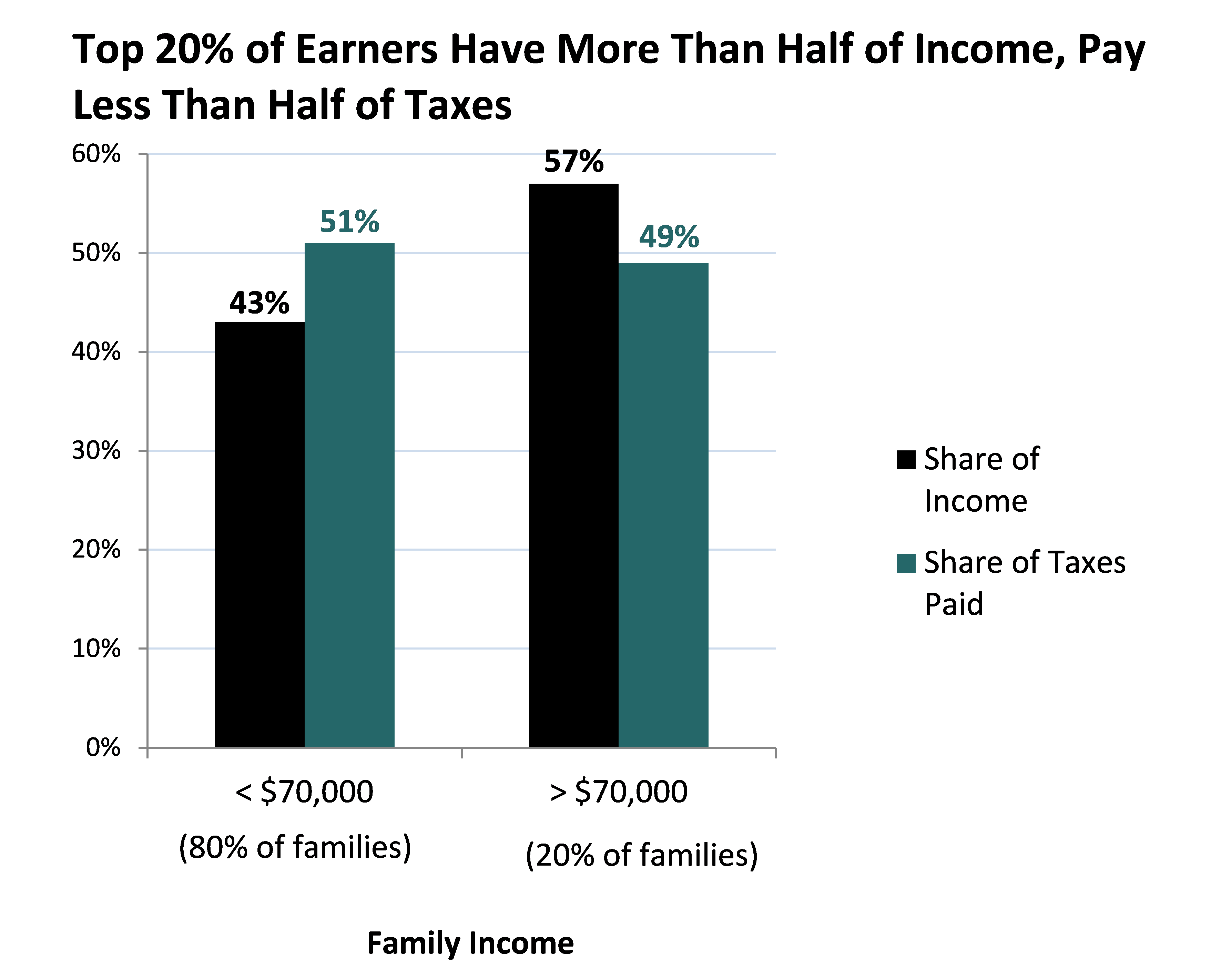

Even when we look at lower income families as a group, they pay more of Mississippi’s taxes than those with higher incomes. The chart below shows the share of income earned and taxes paid by those who earn more than $70,000 and less than $70,000. The 80% of families in Mississippi earning under $70,000 in income have less than half of the income in Mississippi as a group, yet pay more than half of state and local taxes.

Source: MEPC analysis of data from Institute on Taxation and Economic Policy

To lessen the burden on low income families, the state should reduce or eliminate the sales tax on groceries and balance that by make the income tax more progressive. Ways to make the income tax more progressive would be to add a higher income tax bracket and to enact a refundable State Earned Income Tax Credit.

Income inequality hurts us all. Our state tax system shouldn’t make this worse—especially when we have the ability to adjust our tax system to reflect the realities of working families in our state.

You can read more about how Mississippi’s tax system affects low income families in MEPC’s publication, “The Nuts and Bolts of the Mississippi Budget: A Taxpayer’s guide to the Mississippi Budget,” found here.

To learn more about the state and local taxes paid in Mississippi and throughout the nation, refer to this fact sheet from the Institute on Taxation and Economic Policy.

Author: Francinia McKeithan Henry, Policy Analyst/ SFAI Policy Fellow and Sara Miller, Senior Policy Analyst