The Wage Gap, Homeownership, and Economic Mobility

June 8th, 2023

By Sara Miller, Sr. Policy Analyst

As a Black and women-owned financial institution, HOPE supports policies that position women to build assets and remove economic mobility barriers. One perennial policy challenge continues to be the wage gap in earnings by gender and race. And, while income and earnings are not synonymous with wealth, they are certainly contributing to the ability to take advantage of asset-building opportunities like homeownership and small business ownership.

The Wage Gap: Gender and Race

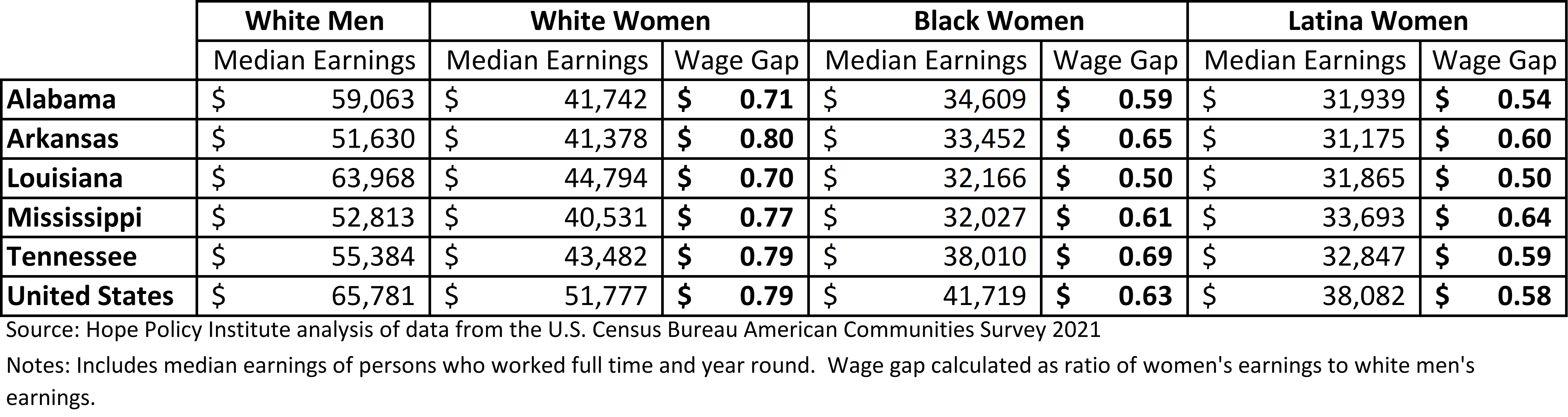

The wage gap in women’s earnings compared with men’s earnings persist, and the disparities are even more evident when looking at gender and race. The figure below shows women’s median earnings by state throughout the Deep South for white women, Black women, and Latina women compared to white men. While white women earn between 70 (Louisiana) and 80 (Arkansas) cents on the dollar of earnings of white men, Black and Latina women earn much less, with an average of 61 cents and 58 cents on the dollar, respectively. In Louisiana, the disparity is even higher. Black and Latina women earn only half of the earnings of white men.[1]

Table 1: Wage Gap Disparities by Race and Gender for Deep South States

The cumulative effects of the wage gap over time have significantly impacted the opportunity for women, especially women of color, to build wealth. This is true for homeownership and small-business ownership, two significant drivers of wealth creation.

Homeownership

Homeownership is critical for wealth generation and crucial in closing the racial wealth gap. Each additional year of homeownership increases a household’s total net worth by an average of $13,700.[2] The median wealth of homeowners ($254,900) is more than 40 times greater than that of renters ($6,270). The median wealth gap between homeowners and renters is even starker among households of color. The median wealth of Black homeowners ($113,130) is 60 times greater than Black renters ($1,830).[3] Homeownership is a proven wealth acquisition instrument, with research showing that even after the Great Recession, the financial returns of homeownership outperformed stocks and bonds.[4]

In the Deep South states of Alabama, Arkansas, Louisiana, Mississippi, and Tennessee, households headed by women, which comprise 28% of all households in the Deep South, are less likely to be homeowners than other households.[5] Only one-half of female head-of-household families are homeowners in the Deep South, compared with 70% for households overall. The homeownership gap is complex. There are several points throughout the life span of a home loan where systemic inequities should be addressed. Some of these disparities show up during the initial home purchase process, with a lack of equitable access to credit. Other structural barriers can make it more difficult for a homeowner to keep their home and build the type of equity that grows generational wealth.

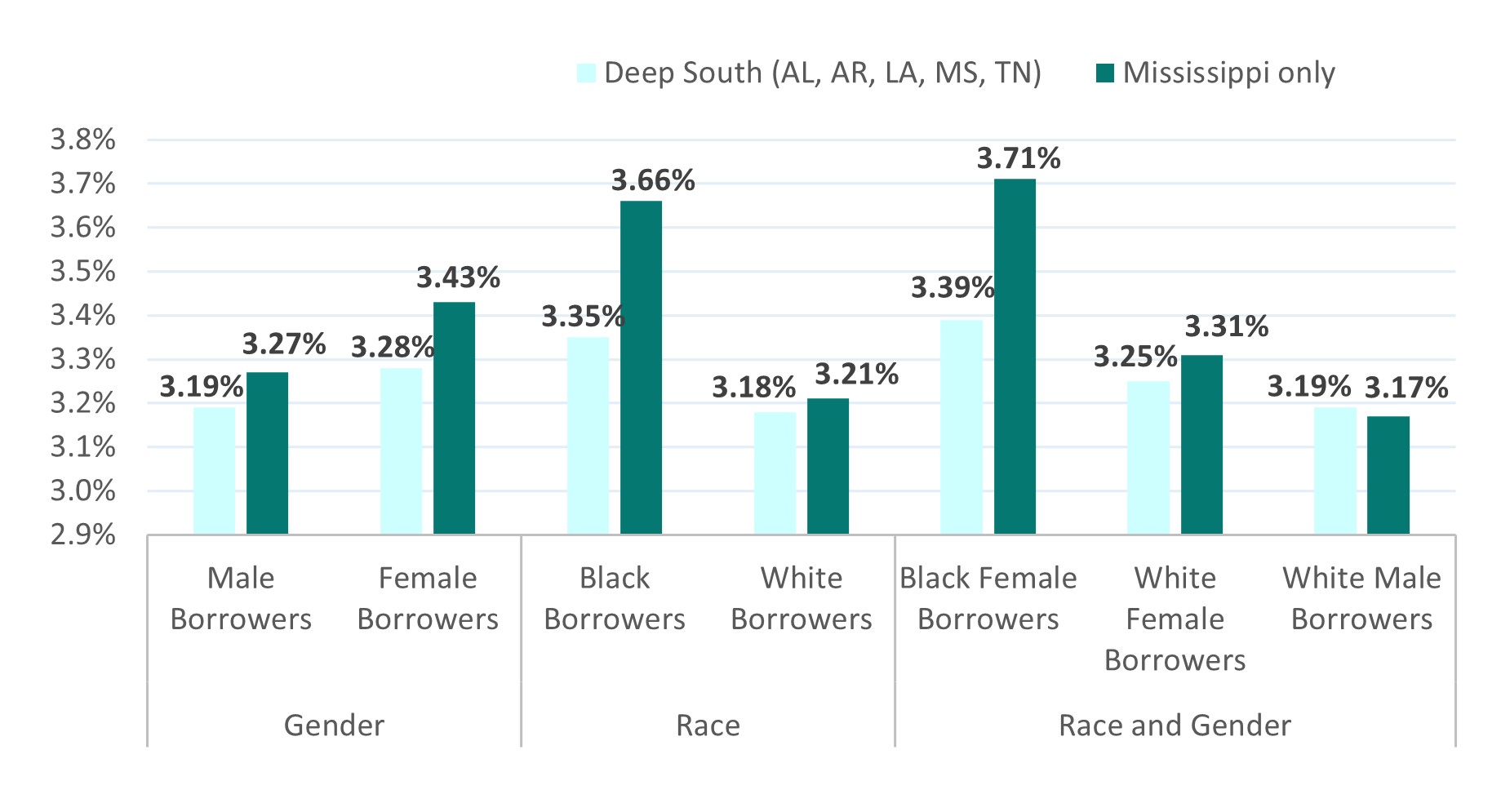

For instance, disparities exist not only in the homeownership rates but also in loan pricing. Black and Women borrowers pay higher interest rates on average. For 2021 loan originations in the Deep South, Black borrowers had an average interest rate of 3.35% compared with 3.18% for white borrowers. The disparities are starkest in the state of Mississippi, where Black female borrowers (3.71%) are paying more than half a percentage point higher than White male borrowers (3.19%) (Figure 1).[6]

A higher interest rate means paying more over the life of the loan and an increased monthly mortgage payment. Higher payments result in slower growth for the home’s equity.

Figure 1: Home Mortgage Interest Rates for Loan Originations in the Deep South (2021)

HOPE has established a mortgage product and lending policies that have improved access to credit for borrowers of color and women. Over the last decade, HOPE’s mortgage portfolio nearly quadrupled from nearly $34 million in 2010 to $130 million at the end of 2022. The percentage of mortgage loans originated for borrowers of color grew from 55% in 2007 to 80% in 2022.

Over the last five years, HOPE has closed 1,041 mortgages for $130 million. Of those mortgages, 78% by number and 76% by dollar were mortgages originated through HOPE’s Affordable Housing Program (AHP). The AHP is one of the single most effective tools available to HOPE to build wealth in the Black community. Of the 749 AHP mortgages originated from 2017-2022, 80% were to Black borrowers, and 58% were to women-headed households.

The work for financial inclusion and closing the racial wealth gap will not be complete without also addressing the wage gap and the disparities in homeownership based on gender and race. Women-headed households are twice as likely (50% of households) than other households (26%) to have children under 18 at home.[7] A family‘s assets are critical in distributing wealth for future generations and for the quality of life of children. Economic mobility for all depends heavily on the policies and practices in place for equitable wages and financial inclusion today.

[1] Hope Policy Institute analysis of data from the U.S. Census Bureau American Communities Survey 2021 Table S0201

[2] 2 M. Turner, T. and Luea, H. (2009). “Homeownership, Wealth Accumulation and Income Status”. Journal of Housing Economics 18, no. 2: 104–11. https://www.k-state.edu/economics/staff/websites/turner/jhe2009.pdf

[3] Joint Center for Housing Studies of Harvard University. (2021). “The State of the Nation’s Housing 2021”. Harvard Graduate School of Design and Harvard Kennedy School. https://www.jchs.harvard.edu/sites/default/files/reports/files/Harvard_JCHS_State_Nations_Housing_2021.pdf

[4] Goodman, L. S., & Mayer, C. (2018). “Homeownership and the American dream”. Journal of Economic Perspectives, 32(1), 31- 58. https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.32.1.31

[5] Hope Policy Institute analysis of data from the U.S. Census Bureau American Communities Survey 2021 Table S1101

[6] Hope Policy Institute analysis of 2021 Home Mortgage Disclosure Act data

[7] Hope Policy Institute analysis of data from the U.S. Census Bureau American Communities Survey 2021 Table S1101