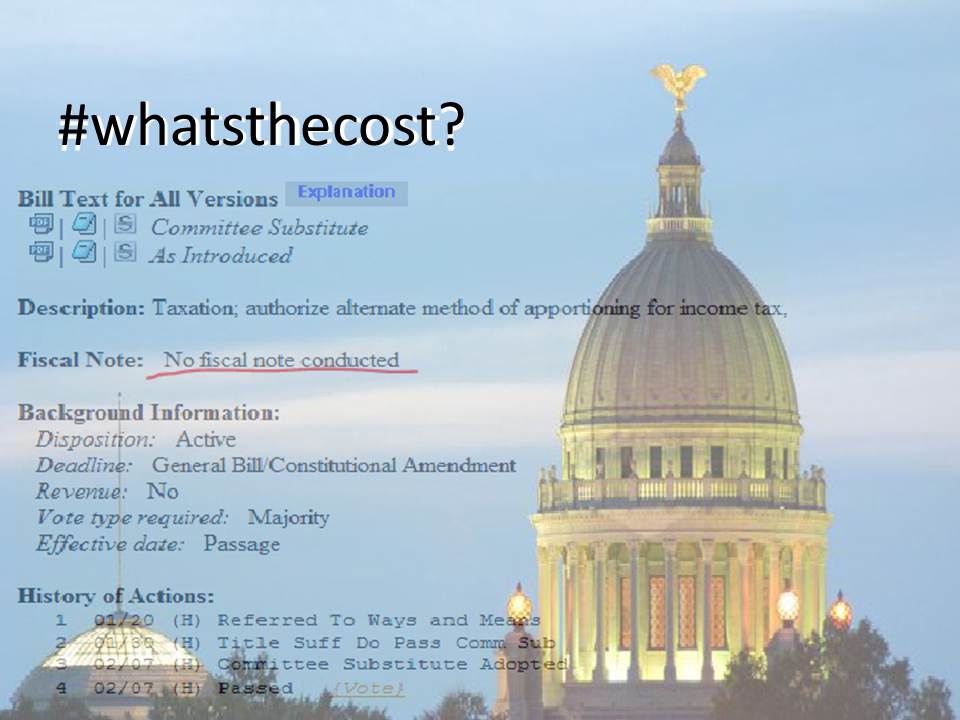

What’s the cost? Act that makes tax avoidance easier signed into law without fiscal note

April 11th, 2014

Earlier this week, HB 799 was signed into law, which, among other things, will make it easier for multistate corporations to justify shifting income earned in MS out of state to avoid corporate income taxes and will lighten penalties for non-payment of taxes for sales and individual income taxpayers. How much will that cost us? It depends on who you ask.

Earlier this week, HB 799 was signed into law, which, among other things, will make it easier for multistate corporations to justify shifting income earned in MS out of state to avoid corporate income taxes and will lighten penalties for non-payment of taxes for sales and individual income taxpayers. How much will that cost us? It depends on who you ask.

Throughout debates on the bill different groups have provided different estimates, some based on only specific sections of the bill. The Department of Revenue estimates the bill will cost $103 million annually. We believe that the $103 million is a reasonable estimate that covers the impact of the entire bill, rather than in part. However, these estimates should have been vetted, established as a fiscal note, and made public well before passage. To date, no fiscal note has been posted.

This bill is just one example of the numerous bills that have been passed this session that should have, but have not had, a fiscal note to tell lawmakers and the public how much they will cost.

With these bills we are making choices between collecting revenue to invest in our schools, roads, health, and workforce or giving tax breaks. We should be able to evaluate how much they will cost so that we can weigh those costs against other priorities.