Inequality Hurts Us All—Our Tax System Shouldn’t Make This Worse

April 19th, 2012

Our state is a better place when we all do well. Unfortunately, our current tax system makes inequality in our state worse by taxing working-poor families deeper into poverty.

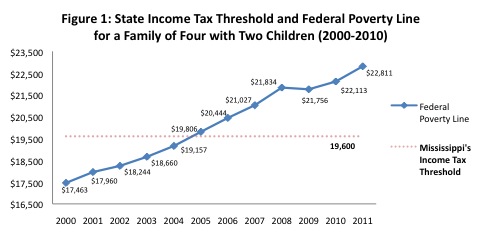

Mississippi’s state income tax threshold, the amount at which persons start having to pay income taxes, has fallen below the federal poverty line since 2005 (See Figure 1, below).

Each year, the federal poverty line rises due to increases in the cost of living. Last year, the federal poverty line rose by $698 from $22,113 to $22,811 for a family of four, while Mississippi’s income tax threshold had no adjustment. Without any adjustment for inflation, more and more individuals living below the federal poverty line will be required to pay state income taxes.

In 2011, a number of states exempted low-income families from state income tax and a many other states offered refunds to low-income working families through Earned Income Tax Credits. 404,394 Mississippiansclaimed the federal Earned Income Tax Credit (EITC) in 2011 which brought an additional $1.5 billion into our state.¹

A state EITC would reduce the income taxes owed and provide a wage supplement for over 360,000 working families living in or near poverty in Mississippi. Research has shown that most families use the EITC to pay for necessities, home repairs, maintaining/replacing vehicles needed to commute to work, and obtaining additional education or training to boost their employability and earning power.²

Inequality hurts us all. Our state tax system shouldn’t make this worse—especially when we have the ability to adjust our tax system to reflect the realities of working families in our state through a state-level Earned Income Tax Credit.

¹http://www.eitc.irs.gov/central/eitcstats/

²Timothy M. Smeeding, Katherin Ross Phillips, and Michael A. O’Connor, The Earned Income Tax Credit: Expectation, Knowledge, Use, and Economic and Social Mobility. http://ideas.repec.org/p/max/cprwps/13.html