Consumer Protection Rollbacks Will Worsen Conditions for Cash Strapped Households

February 18th, 2020

Having a savings account is one of the best ways to get through financial hardship, but many households lack the savings or assets easily converted to cash to sustain themselves. The 2020 Prosperity Now Scorecard reveals that 46 million households are living in liquid asset poverty, and many of these households are located in the Deep South states of Alabama, Arkansas, Louisiana, Mississippi and Tennessee. Cash is an important resource for communities that are situated on the fringe of financial services; yet developing threats to consumer protections may worsen the financial outlook for those who need protection the most.

The first line of defense when managing a financial crisis is easily accessible money. Liquid asset poverty is the absence of easily accessible cash or products that can be quickly converted to cash e.g. stocks, mutual funds, and bonds. Prosperity Now measures liquid asset poverty as the percentage of households without sufficient liquid assets to subsist at the poverty level for three months in the absence of reliable income. Without a financial cushion or steady income, households living in liquid asset poverty are more likely to rely on debt and credit, typically from alternative financial services providers, such as payday lenders and car-title lenders, to subsist during financial hardship. Alternative financial service providers offer high-cost-loans at terms too stringent for borrowers to repay in time. Many borrowers refinance their loans at higher interest rates or default, with either case increasing their debt load and further decreasing their financial stability.

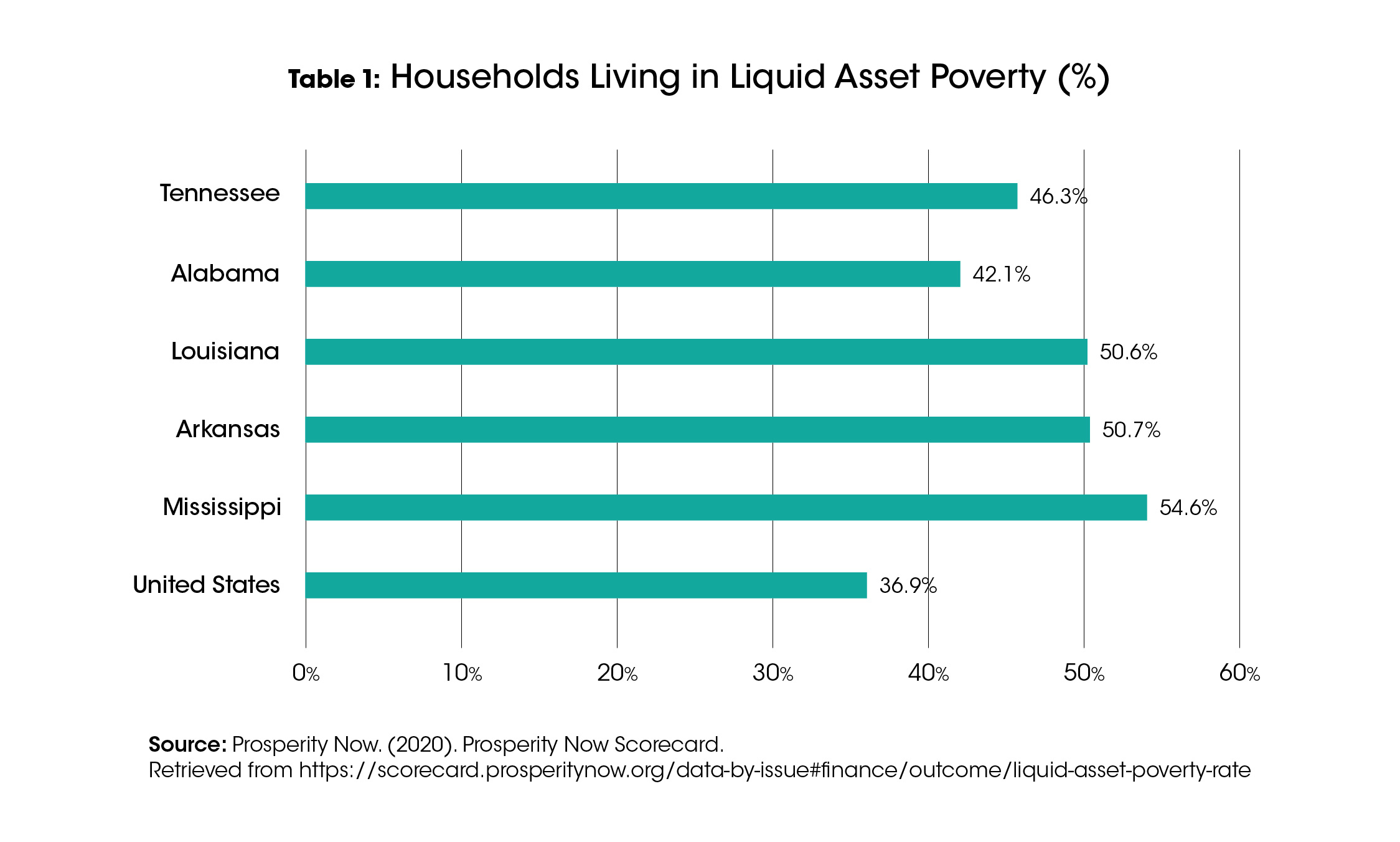

In the United States, just over one third (36.9%) of households are living in liquid asset poverty. Mississippi has the highest percentage of liquid asset poor households (54.6%) with Arkansas and Louisiana close behind (both 50%). Alabama and Tennessee also have rates higher than the national percentage (42% and 46%, respectively). See Table 1

Liquid asset poverty moves beyond simple measures of income and poverty to illustrate how saving can help families withstand a financial setback that would otherwise spiral them into deeper financial strain. Research shows that households with as little as $250 to $750 in liquid assets, savings in particular, are more likely to keep up with payments and avoid devastating consequences, like an eviction in the event of a financial crisis.[i] Additionally, having cash available to pay for emergencies or unexpected bills better positions households to start or continue to engage in other wealth building activities, like saving for a down payment on a house. The 2020 Scorecard, however, reports that nearly one third of households do not have a savings account and just over two in five cannot put any money aside to help them meet an unexpected expense or economic shock. Numerous factors can explain why some households are unable to save. High rates of unemployment, limited to no access to mainstream financial institutions, and staggering debt are examples of barriers to saving.[ii] Together, these factors leave households financially vulnerable and subject to predatory practices. High-cost lenders disproportionately extract wealth from Black and Latino communities, and drain more than $1.6 billion every year from low-income borrowers in the Deep South.[iii]

Over the last several decades, important consumer protections have been enacted at the state and federal level to protect against predatory and discriminatory financial practices, which are critical to helping people keep and save the money they earn. Unfortunately, several new policy developments at the federal level undermine this progress. Recently proposed rollbacks in consumer protections on payday lending fair housing and interest rate caps, in addition to a challenge to the constitutionality of the Consumer Finance Protection Bureau (CFPB) may further entrench vulnerable communities in conditions of low wealth for generations to come.

The collective impact of these developments would allow predatory lenders and banks to extract critical capital resources from the vulnerable communities we serve with no obligation to re-invest. HOPE is committed to raise awareness on the harm of the proposed revisions to ensure economic mobility for communities throughout the Deep South.

[i] Signe-Mary McKernan, Caroline Ratcliffe, Breno Braga, Emma Cancian Kalish. Thriving Residents, Thriving Cities: Family Financial Security Matters for Cities. April 2016, Urban Institute, https://www.urban.org/research/publication/thriving-residents-thriving-cities-family-financial-security-matters-cities

[ii] See Louisiana, Mississippi Least Banked States in the Nation for more information on unbanked and underbanked status.

[iii] Center for Responsible Lending, “Payday and Car-Title Lenders Drain Nearly $8 Billion in Fees Every Year,” April 2019.