Scorecard: Mississippians Lack Sufficient Net Worth

February 27th, 2014

This week is America Saves Week, an annual national campaign to promote positive savings behavior and to provide a chance for individuals to assess their own savings status and take financial action to save money, reduce debt, and build wealth. In Mississippi, this is a significant challenge. According to the Corporation for Enterprise Development’s (CFED) 2014 Assets & Opportunity Scorecard, which comprehensively examines the ability of Americans to achieve financial security, 61.9 percent of Mississippi households do not have a basic personal safety net to prepare for emergencies or future needs, such as a child’s college education or homeownership. This lack of savings makes Mississippians among the most financially vulnerable, particularly in the event of an economic setback like a job loss, health crisis or other income-disrupting emergency.

This week is America Saves Week, an annual national campaign to promote positive savings behavior and to provide a chance for individuals to assess their own savings status and take financial action to save money, reduce debt, and build wealth. In Mississippi, this is a significant challenge. According to the Corporation for Enterprise Development’s (CFED) 2014 Assets & Opportunity Scorecard, which comprehensively examines the ability of Americans to achieve financial security, 61.9 percent of Mississippi households do not have a basic personal safety net to prepare for emergencies or future needs, such as a child’s college education or homeownership. This lack of savings makes Mississippians among the most financially vulnerable, particularly in the event of an economic setback like a job loss, health crisis or other income-disrupting emergency.

Furthermore, an overwhelming amount of Mississippi households do not have sufficient net worth to allow them to live even at the poverty level for three months if they were to lose their regular income.

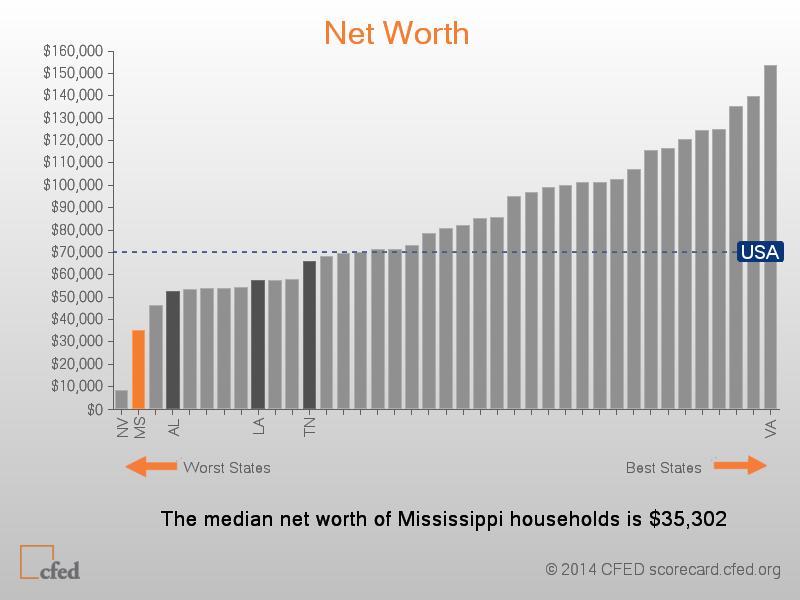

A family’s net worth represents the amount of financial cushion a household has to respond to unexpected events, such as a job loss or unforeseen medical expenses, as well as to take advantage of opportunities like financing higher education, purchasing a home or starting a small business. A group’s median net worth is the value of assets held by households at the middle of the wealth distribution and is a basic indicator of a household’s wealth and financial well-being. Households in Mississippi accumulate fewer assets than households in the rest of the nation – Mississippi ranks second to last, only behind Nevada, in median net worth. The median net worth in Mississippi is $35,302 while the median net worth in the United States is $70,359 (See Chart).

There are many opportunities for our state to address our high level of asset poverty and put Mississippians on a path to financial prosperity. First, we can make sure families are connected to mainstream financial institutions. Families attached to banks and credit unions (see our earlier post on unbanked Mississippians) are more likely to have the tools necessary to save money, reduce debt, and build wealth. Another exciting opportunity would teach the value of long-term savings to our state’s children. Children’s Savings Accounts (CSAs) are long-term, asset-building accounts established for children at birth that provide families with a tax-free way to build assets to finance higher education, purchase a home, start a small business, or fund retirement. Finally, Mississippi can also expand support for Community Development Financial Institutions (CDFIs) and Community Development Credit Unions (CDCUs), which have a long track record of meeting the needs of historically underserved populations.

Sources:

Corporation for Enterprise Development. (2014). Assets and Opportunity Scorecard, 2014. Retrieved from http://assetsandopportunity.org/scorecard/

America Saves Week

February 24 – March 1, 2014 is America Saves Week – a national campaign that aims to promote good savings behavior and provide a chance for individuals to assess their own savings status. For more information on the week, including how to create and commit to a basic savings plan, follow @HopeCreditUnion and @MEPConline on Facebook and Twitter.